Budgeting & Forecasting

Enterprise budgeting and forecasting are more than just finance exercises – they are strategic tools for CFOs, CIOs, and Heads of Strategy to govern the portfolio of initiatives. Keto AI+ brings a product-focused approach to financial planning that links finance with strategic execution, ensuring every investment is aligned to business goals and adaptable to change. The platform’s budgeting and continuous forecasting capabilities enable optimized funding allocation, early risk detection, and agile decision-making across the enterprise portfolio.

Strategic Budgeting for Portfolio Governance

Effective budgeting underpins strategic portfolio governance, ensuring resources flow to the highest-value initiatives. By using Keto AI+ to evaluate business cases and enforce funding discipline, leadership can align spending with strategic priorities and filter out low-value “pet projects.” A governance board can require each major proposal to tie back to strategic goals and ROI, creating a direct link between budget approvals and strategy. Research by McKinsey has shown that companies which rigorously reallocate resources to strategic priorities (instead of simply repeating last year’s allocations) achieve significantly higher returns. Keto AI+ supports this rigor through standardized financial frameworks – from comparing investments on an apples-to-apples basis (ROI, NPV, IRR) to tracking budget compliance – so that decisions are based on facts and value. The result is optimized allocation of funds across initiatives, with finance teams and portfolio managers having full transparency into where each euro or dollar is going and what it’s achieving. This tight governance ensures that the organization’s strategic objectives are fully funded and backed by data-driven approvals, not gut feel.

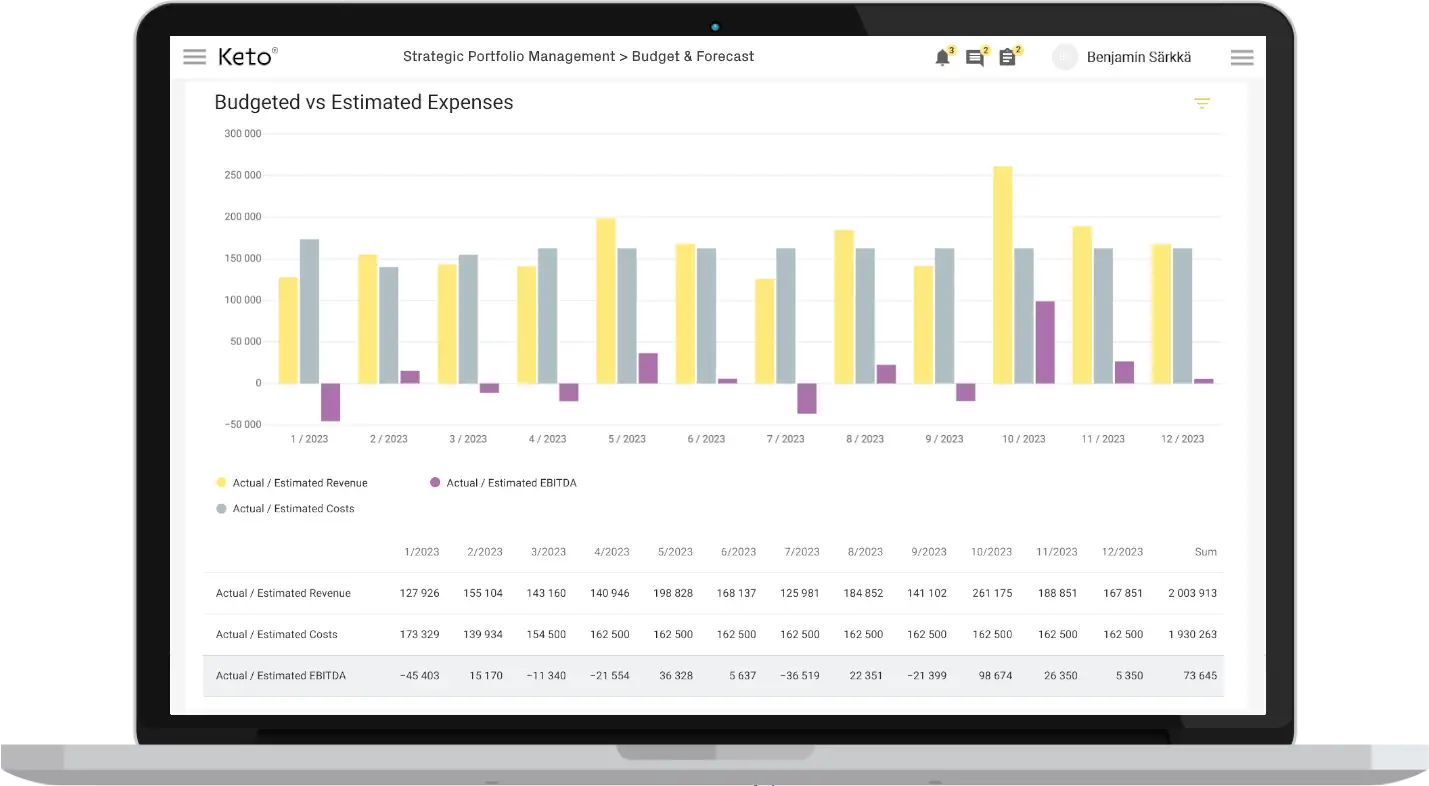

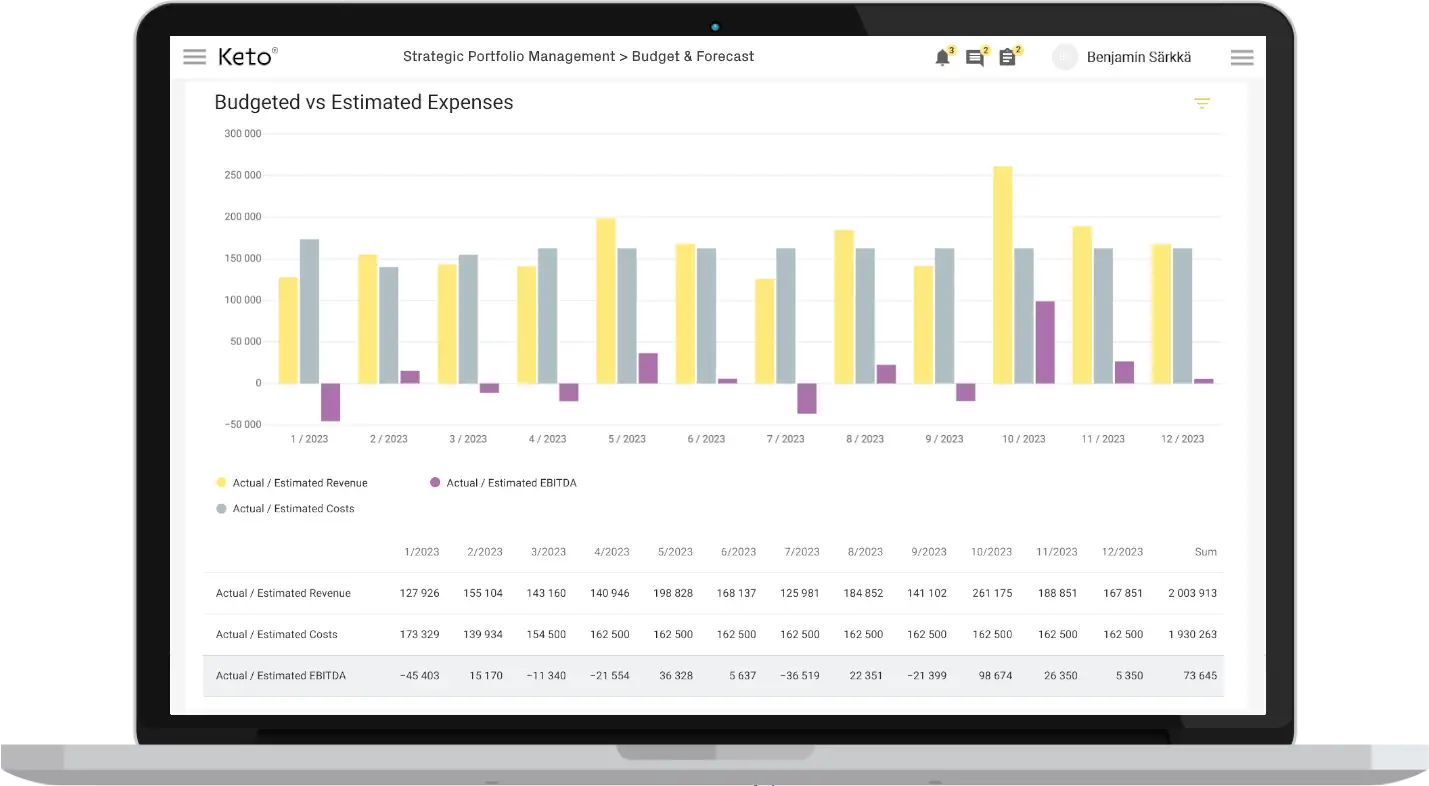

Continuous Forecasting for Portfolio Health & Agility

In a dynamic business environment, a static annual budget is not enough. Keto AI+ enables continuous forecasting that helps maintain portfolio health throughout the year. CFOs can make investment governance a continuous process – for example, conducting quarterly portfolio rebalancing – rather than a one-time annual exercise. Through rolling forecasts and real-time updates, the platform gives early warnings when projects deviate from plan. Leaders get visibility to identify risks early, improving the odds of successful delivery. For instance, Keto’s dashboards and AI analytics can flag anomalies such as a project whose burn rate suggests it will exceed budget in a few months or an initiative where a key benefit metric (e.g. user adoption) is lagging. Armed with these insights, decision-makers can course-correct promptly – reallocating funds, adjusting scope, or addressing performance issues before they escalate. Gartner observed that organizations effective at dynamic reallocation and adjustment are far more likely to achieve their strategic objectives. This kind of financial agility, enabled by continuous forecasting, lets enterprises “double down” on winning investments or pull back from underperformers sooner to keep the overall portfolio optimized. In short, Keto AI+’s proactive forecasting and alerting capability acts as an early warning system to protect portfolio value and ensure resources are always optimally deployed.

ERP Integration for Real-Time Oversight (SAP, etc.)

A key feature of Keto AI+ is its integration with enterprise ERP systems like SAP to provide real-time visibility of actual vs. planned spending. Situational awareness of budget performance is crucial for CFOs and PMOs – and the platform delivers this by automatically pulling in actual expenditure data and matching it to your budgets and forecasts. Keto AI+ can connect to financial systems (e.g. SAP) to import actual spending for each project and compare it against the planned budget and latest forecast, creating one source of truth for financial status.

Dynamic Planning & Multi-Year Forecasts

Strategic initiatives often span multiple years, and Keto AI+ supports dynamic financial planning to handle that complexity. The platform enables multi-year forecasting at both the project and portfolio level, so CFOs can map out the financial trajectory of initiatives over 3, 5, or even 10 years. This long-term view is critical for understanding the sustainability and payoff of strategic investments. Keto AI+ makes it easy to maintain rolling multi-year plans: as project timelines shift or assumptions change, you can instantly see the impact on out-year budgets, capital requirements, and expected returns. In practice, a CFO might use Keto to keep a rolling five-year projection updated quarterly with actuals and latest assumptions, along with best-case and worst-case scenarios for major programs. The moment market conditions shift or new opportunities arise, the forecast can be recomputed to model “what-if” scenarios – for example, what if we delay Project X by 6 months or increase its scope? – showing how such changes would affect cash flow, resource needs, and ROI. By building scenario planning into the forecasting process, Keto AI+ helps leadership evaluate trade-offs and make informed adjustments to the strategic roadmap. Notably, many companies struggle to connect strategy and long-term finance – a recent survey found barely half of organizations translate strategy into a 3-7 year financial plan. Keto AI+ addresses this gap by making long-range planning a living process: plans are continuously aligned to strategy and reality, rather than static documents. This dynamic approach ensures agility and confidence that the multi-year strategy is financially sound under various conditions. Leaders can commit to strategic bets knowing they have a flexible plan that can adapt to change.

Benefit Tracking & Investment Performance Monitoring

Tracking the realized value of investments is as important as tracking costs. Keto AI+ brings benefit realization into the budgeting and forecasting process, allowing CFOs and strategy heads to monitor whether initiatives deliver the expected outcomes. In many organizations, benefits tracking is a weak spot – studies show low maturity in benefits realization, which often correlates with a higher rate of failed or underperforming projects. Keto AI+ helps close this gap by linking each project’s budget to its intended benefits and providing tools to measure progress. For example, you can define clear benefit targets (e.g. revenue gains, cost savings, ROI percentage) for each initiative and then track metrics and KPIs during execution to see if those targets are being met. The platform’s dashboard includes benefit metrics alongside financials, so at any time you can review not only how much has been spent on an initiative, but also what value it’s generating (e.g. incremental revenue, margin improvement, customer satisfaction index). If a benefit metric is lagging or a project’s projected value is dropping, Keto AI+ will flag it – prompting timely corrective action to maximize ROI. This performance monitoring extends to post-project reviews as well: by comparing expected vs. actual benefits after an initiative completes, finance leaders can derive insights to improve future forecasts and investment decisions. Embedding benefit tracking into portfolio financial management creates a value-centric culture where success is defined not just by delivering on time and on budget, but by delivering tangible results to the organization’s bottom line. As Forrester observed, Strategic Portfolio Management is fundamentally about guiding investments to maximize value – and value can only be maximized if it is measured. Keto AI+ ensures that every dollar invested is tied to measurable strategic outcomes, giving executives a clear view of investment performance and strategic impact.

Linking Finance with Strategic Execution

Keto AI+’s Budgeting & Forecasting capabilities highlight the platform’s core business value: connecting financial management with strategic execution. By integrating budgets, forecasts, ERP actuals, and outcome metrics in one system, it provides a “boardroom-ready” holistic view of the portfolio’s financial health and strategic progress. Finance and strategy leaders gain a unified cockpit to steer the enterprise – they can allocate funds based on strategic merit, continuously monitor execution, and adjust course as needed to ensure the strategy delivers results. In effect, Keto AI+ turns financial data into a strategic asset: CFOs and CIOs get real-time insights and analytics to make confident decisions, keep the portfolio optimized, and align every initiative with the organization’s goals. By linking finance with strategy in an actionable way, the platform empowers enterprises to achieve their objectives with greater transparency, discipline, and agility. The outcome is a well-governed, responsive portfolio where plans and investments translate into measurable business value, closing the gap between lofty strategic plans and effective execution.

In summary, Budgeting & Forecasting with Keto AI+ helps the executive suite bring strategy to life financially. From optimized budget allocation and continuous forecasting to ERP-integrated oversight and benefits tracking, Keto AI+ provides the robust toolkit needed to unite the world of finance with the world of strategy. Leaders can plan with confidence, manage with insight, and deliver on their strategic ambitions knowing that every investment is accounted for and contributing to enterprise success.

Read next