Financial Management

Empower Strategic Finance: In large enterprises, CFOs, finance controllers, and portfolio budget owners face the challenge of aligning financial plans with strategic priorities. Studies show that 60% of organizations do not link their financial budgets to strategic objectives, contributing to wasted investments and missed goals. Without effective Strategic Portfolio Management (SPM), up to 70% of digital investments could fail to meet expectations. The Keto AI+ Platform for SPM closes this gap by making financial management a strategic strength rather than a bottleneck. It enables robust strategic financial planning, portfolio investment decision support, and continuous forecasting – all in one integrated solution. With Keto AI+, finance leaders can ensure every euro, pound, or dollar is optimally allocated to strategic initiatives and delivers measurable value.

Strategic Financial Planning & Portfolio Forecasting

Keto AI+ brings a long-range, strategic lens to financial planning. Finance leaders can perform multi-year planning that links directly to business strategy – allocating budgets across a 3-5 year horizon in line with the company’s strategic roadmap. This big-picture view ensures that short-term budgets and project funding decisions support sustainable growth and long-term objectives. You can easily map out future investment needs for key initiatives and forecast expected costs and benefits over time, avoiding surprises down the road.

Equipped with advanced analytics, the platform helps CFOs evaluate trade-offs and optimize the portfolio mix. What-if scenario analysis allows you to model different funding plans and assess their impact. For example, you can compare the outcomes of investing more in a digital transformation program versus a new market expansion. Keto’s AI-driven insights and intuitive visualizations highlight the projected ROI and strategic impact of each scenario. This clarity enables data-driven portfolio investment decisions and faster course corrections. In other words, it provides the visibility and intelligence needed to make the “fast, data-driven decisions” that experts like Forrester emphasize as critical to strategy execution. By understanding the trade-offs of various scenarios, you can confidently choose a path that maximizes ROI and aligns with your strategic goals.

Centralized Budgeting and Funding Workflows

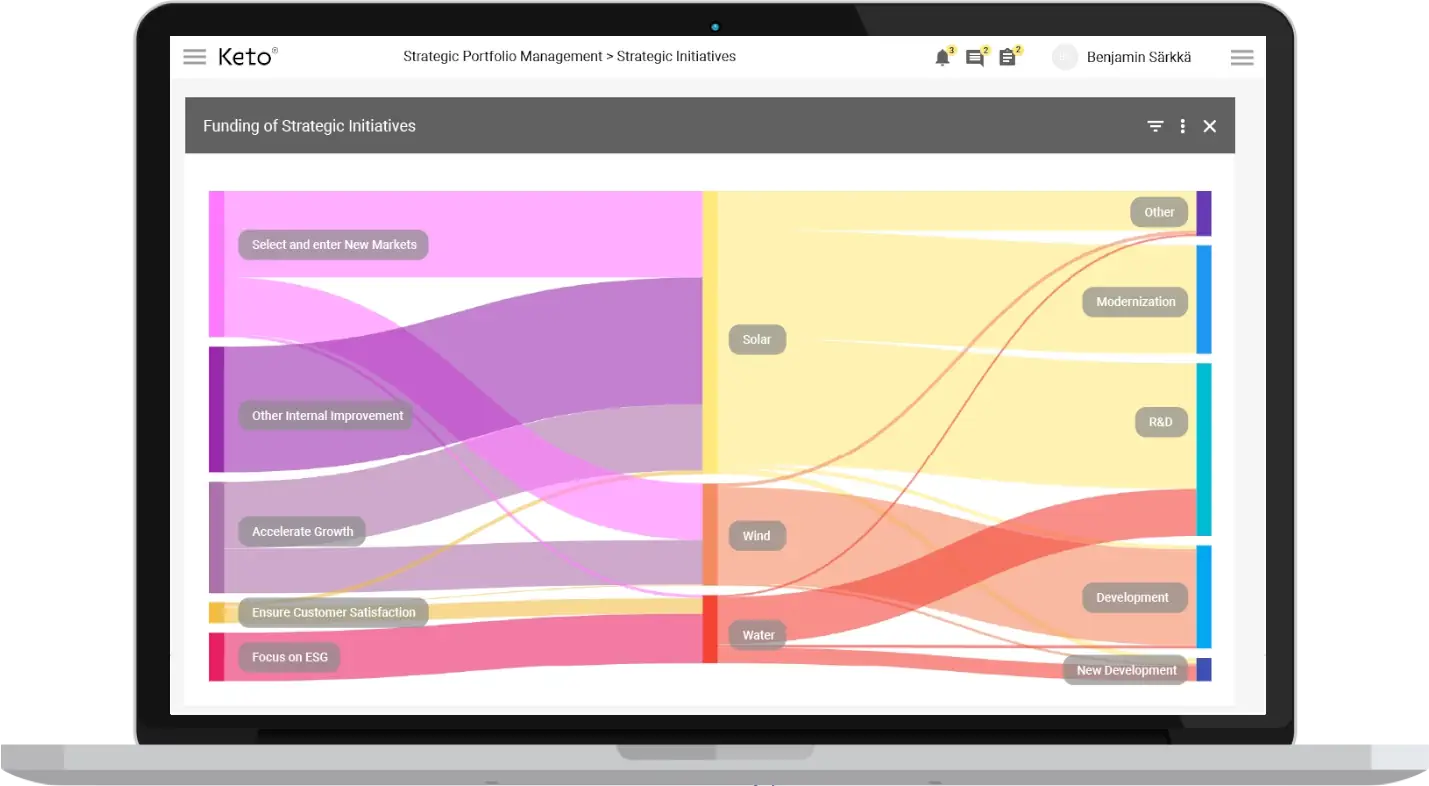

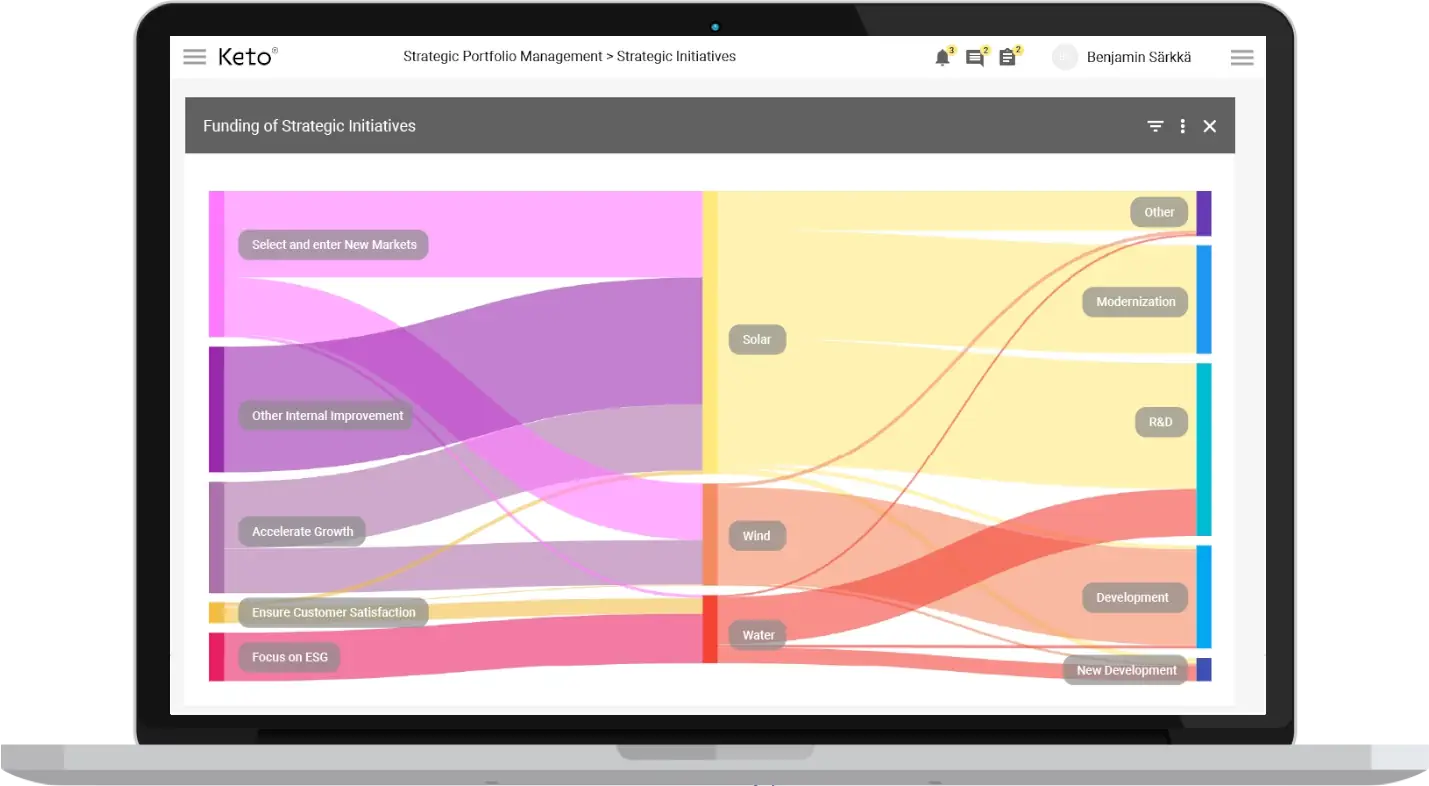

Keto AI+ provides dynamic visualizations (like funding flow diagrams) to show how budgets are allocated across strategic initiatives, helping finance teams ensure alignment and optimal resource distribution.

Keto AI+ Financial Management centralizes all portfolio budgeting and funding processes in one place. Instead of juggling siloed spreadsheets and disconnected reports, CFOs and controllers get a single source of truth for all investment data. The platform provides structured workflows for budgeting and funding approval – from initial proposal to final sign-off. Portfolio budget owners can submit funding requests for strategic initiatives, route them through approval chains, and track status in real time. This streamlines what is often a convoluted process, ensuring transparency and accountability for every funding decision.

Crucially, Keto enables continuous planning and agile reallocation of funds. As business priorities evolve or projects change, you can quickly re-prioritize and reallocate budgets to where they’re needed most. For instance, if a new regulatory requirement or market opportunity emerges mid-year, Keto makes it easy to shift funding from lower-value activities to that urgent initiative. This flexibility ensures that funding is always directed to the initiatives that drive the most value, rather than being locked into a static annual plan. Built-in investment governance controls support these workflows – you can enforce stage gates, require business cases with projected benefits, and set criteria to evaluate funding requests. Every investment is evaluated not only on cost, but on strategic merit and expected ROI, reinforcing alignment between the finance team and the enterprise’s strategic objectives.

Real-Time Cost Tracking and ERP Integration

Timely, accurate actuals are the lifeblood of effective financial management. Keto AI+ integrates seamlessly with enterprise ERP and financial systems (such as SAP, Oracle, or Microsoft Dynamics) to import actual spend data for projects and programs. This means your budget forecasts in Keto are continually updated with real costs, providing real-time cost tracking across the portfolio. CFOs and finance controllers gain instant visibility into how each initiative is performing against its budget. If a project is overspending, you’ll see it immediately; if an initiative is underutilizing funds, that becomes evident as well. This real-time insight allows for proactive adjustments – you can course-correct mid-flight by curbing spending, augmenting budgets, or re-forecasting as needed to stay on track.

Integration with ERP systems also eliminates manual data reconciliation and errors. Keto AI+ acts as a financial hub, automatically consolidating planned budgets, forecasts, and actual expenditures in one dashboard. Finance teams no longer have to manually pull reports from SAP or reconcile spreadsheets to understand financial status – Keto provides a live window into all project financials. Moreover, the platform can push updates or alerts when certain thresholds are exceeded (for example, if a program reaches 80% of its budget). By bridging portfolio plans with accounting actuals, Keto AI+ ensures that decision-makers are always working with current, trustworthy data. The result is tighter financial control and the ability to respond quickly to changing conditions – a critical capability in today’s fast-paced environment.

Aligning Investments with Strategy and Value

One of the greatest benefits of Keto AI+ Financial Management is the connection it creates between every dollar spent and the strategic value delivered. In the platform, each project, program or strategic initiative is linked to the high-level objectives it supports – whether that’s a strategic goal, OKR, or business priority. This means CFOs and portfolio managers can clearly see why money is being spent: how each budget line ties back to strategic objectives and what value it is expected to generate. By making strategic alignment explicit, Keto helps ensure that resources are not wasted on low-impact work. (Notably, misalignment is a common problem – PMI reports 44% of strategic initiatives fail often due to poor alignment, a pitfall Keto helps organizations avoid.)

Beyond alignment, Keto AI+ puts a strong emphasis on value realization. The platform enables you to define expected benefits for each initiative (such as revenue growth, cost savings, customer satisfaction improvements, etc.) and then track those benefits through the life of the initiative. This benefit tracking closes the loop between investment and outcome. Stakeholders can compare initial business case projections with actual results, ensuring that the strategic benefits that justified the project are actually being realized. Few organizations do this well today – even though 85% require business cases, less than 10% actively track whether those projected benefits were achieved pmi.org. Keto AI+ makes benefits realization a built-in discipline rather than an afterthought. With dashboards for benefit metrics and post-implementation reviews, finance leaders can monitor the ROI and strategic impact of every investment in the portfolio. If a project isn’t delivering the expected value, you have the insights needed to intervene, reassess its business case, or redeploy its funds to higher-value uses. In short, Keto connects financial data to strategic outcomes, giving enterprises the tools to maximize value from their portfolios and truly translate strategy into results.

Key Features at a Glance

-

Multi-Year Planning: Plan and manage budgets over multiple years to support long-term strategic initiatives. Keto AI+ lets you allocate funding across fiscal years, so you can visualize and adjust the total cost of ownership of initiatives that span beyond the annual budget cycle. This ensures that multi-year programs (e.g. a 3-year digital transformation) are properly funded and aligned with future targets, not just immediate-year goals.

-

Funding Scenario Analysis: Evaluate different portfolio funding scenarios with ease. Through what-if analysis, you can simulate changes like budget increases, cuts, or reprioritization of investments. Keto provides side-by-side comparisons of scenarios, showing impacts on key metrics (such as total spend, projected benefits, or capacity needs). This scenario planning capability helps finance teams and portfolio committees choose the optimal investment path under various constraints.

-

Benefit & Value Tracking: Track expected vs. realized benefits for each investment. Define key benefit metrics (financial or non-financial) during project initiation and let Keto AI+ monitor them throughout execution and after completion. You can quantify value delivered (e.g. cost savings realized, revenue uplift, efficiency gains) and compare it against the original plan. This feature supports a culture of accountability and continuous improvement by focusing on outcomes, not just outputs.

-

Investment Governance: Enforce structured processes for evaluating and governing investments. Keto AI+ supports stage-gate approvals, ensuring projects meet specific criteria before advancing or receiving additional funding. Customize approval workflows to involve the right stakeholders (finance, strategy, IT, etc.) at each stage. All decisions and assumptions are logged for auditability. This governance framework ensures that the portfolio is systematically reviewed and realigned with strategy, and that resources are steered to the highest-value initiatives at all times.

-

ERP Integration for Actuals: (Integration is a core strength of the Keto platform, as mentioned above.) Out-of-the-box connectors and API integrations bring in actual cost data from systems like SAP, allowing for automatic updates of spend information. This means your budget vs. actuals reports in Keto are always up to date without manual effort. The integration also works in reverse – you can export or report portfolio financial data back to finance systems or BI tools, ensuring finance and strategy teams are in sync.

-

AI-Powered Insights: Leverage Keto’s AI+ capabilities for smarter financial management. The platform’s AI can assist in identifying anomalies (e.g. flagging projects likely to overspend based on early burn rate), predicting outcomes (using historical data to improve forecast accuracy), and even drafting analyses or reports. For example, Keto’s AI features can auto-generate visual financial reports or perform sentiment analysis on project status to highlight risk. These intelligent features amplify the finance team’s ability to derive insights quickly and focus on strategic decisions rather than number-crunching.

Insights from Industry Leaders

Industry research underscores why strategic portfolio financial management is so critical in today’s enterprise environment:

-

Gartner: Gartner defines Strategic Portfolio Management as the capabilities needed to align investments with strategic goals, and warns that by 2025, 70% of digital investments will fail to meet expectations without effective SPM. Conversely, organizations with robust SPM practices are far more likely to realize business value – in fact, they are 2.2 times more likely to achieve their expected outcomes and 3.3 times more resilient to change. This highlights the tangible impact of having tools like Keto AI+ to drive alignment and adaptability in financial planning.

-

Forrester: Forrester Research emphasizes the need for visibility and agility in linking strategy to execution. Margo Visitacion, a VP and Principal Analyst at Forrester, notes that successful organizations achieve this by “bringing visibility, ensuring alignment, and enabling fast, data-driven decisions”. Keto AI+ embodies this principle – providing finance and portfolio leaders with real-time visibility into financial data, alignment of budgets to strategy, and the analytics to make quick, informed decisions in an uncertain business climate.

-

McKinsey: McKinsey & Company finds that companies who actively manage and reallocate their project portfolios create significantly more value. In fact, organizations that regularly prioritize and adjust their portfolios outperform their peers by 40% in terms of returns. This speaks to the importance of continuous portfolio optimization and agile budgeting. Keto AI+ supports this with continuous planning and scenario analysis, allowing enterprises to emulate the “active portfolio management” that McKinsey identifies as a driver of superior performance.

-

PMI (Project Management Institute): PMI’s research highlights the high cost of poor strategic alignment and benefits realization. They report that 44% of strategic initiatives fail due to misalignment and weak implementation. Even when projects are completed, organizations on average realize only about 60% of the intended strategic value of those initiatives, often because benefits are not tracked or fully realized. These sobering statistics underline why features like Keto’s benefit tracking and strategic alignment dashboards are indispensable – they help ensure that execution stays tied to strategy and that promised benefits are delivered. By providing financial transparency and accountability, Keto AI+ helps organizations avoid becoming part of these negative statistics and instead achieve the full value of their investments.

In summary, Keto AI+ Financial Management elevates the role of finance in Strategic Portfolio Management. It gives CFOs and portfolio budget owners the tools to plan wisely, govern investments rigorously, and link every dollar to strategic impact. With centralized budgeting, real-time actuals, and AI-enhanced insights, organizations can move from static, siloed budgeting to a dynamic, strategy-driven approach. The result is greater financial visibility, smarter investment decisions, and ultimately, higher ROI on the portfolio of strategic initiatives – ensuring that the company’s strategy is executed with maximum financial efficiency and business impact.

Read next