The Future of Strategic Portfolio Management: Trends and Innovations

In today’s rapidly evolving business landscape, strategic portfolio management (SPM) has moved to the forefront of the executive agenda. Organizations – especially large enterprises with thousands of employees – are recognizing that effectively aligning projects and initiatives with broader business strategy is critical for staying competitive. The stakes are high: studies have estimated that about 67% of well-formulated strategies fail due to poor execution.

This execution gap is now a top concern for leaders like CIOs, Heads of Strategy, and CFOs, who are accountable for turning strategy into results. In fact, many leaders feel unprepared to bridge this gap – one study found 61% of executives were not ready for the strategic challenges they faced upon entering senior leadership roles.

It’s no surprise, then, that by 2026 Gartner predicts 30% of organizations will have embraced strategic portfolio management and invested in the necessary talent and tools to become industry leaders.

Business leadership is increasingly viewing SPM not as a “nice-to-have,” but as an essential discipline to navigate complexity and drive successful strategic change.

Why is SPM such a priority now?

One major reason is the need for greater visibility and control in strategy execution. In many large organizations, decisions about project investments have historically been siloed, leading to misalignment between the executive suite and project teams. One recent global survey found that fewer than 30% of companies have an integrated, enterprise-wide portfolio management process, resulting in communication breakdowns and poorly aligned investments.

Moreover, executives often overestimate how strategically their teams are managing the portfolio, which contributes to misalignment and silos across the business.

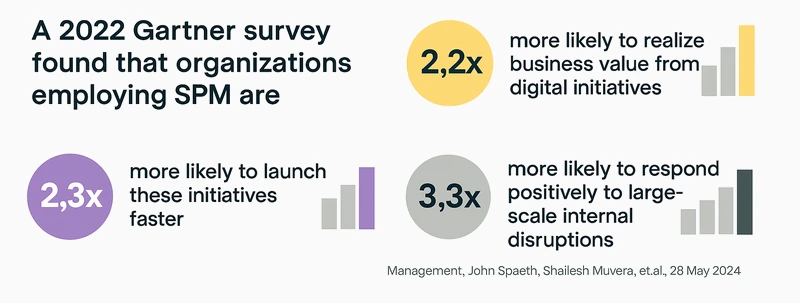

With economic uncertainty and rapid technological shifts, business leaders cannot afford such disconnects – they need a clear line of sight from strategic plans down to execution. This demand has put SPM in the spotlight as a solution that provides structured roadmaps, data-driven prioritization, and cross-organizational transparency. For early adopters, the benefits are tangible: organizations that practice effective SPM are over twice as likely to realize value from their digital initiatives and more than three times as likely to respond effectively to major disruptions.

In short, SPM is becoming a key enabler for the C-suite to steer the company toward its strategic objectives with confidence.

What does the near future hold for strategic portfolio management? Below we explore several emerging trends and innovations that are shaping SPM from a business leadership perspective. These trends reflect the evolving needs of directors and executives who oversee strategy execution.

- Dynamic Strategic Roadmapping and Alignment: More organizations are adopting dynamic roadmapping practices to continuously align projects and programs with strategic objectives. Instead of static annual plans, business leaders are embracing rolling roadmaps that can be adjusted as market conditions change. This trend is driven by the need for agility at the top – for example, a Head of Strategy may update the strategic initiative roadmap quarterly to seize new opportunities or respond to threats. Modern SPM approaches make this possible by providing a holistic view of all strategic initiatives and their status. Leaders can visualize how various projects contribute to strategic goals and quickly reprioritize if needed. The emphasis is on maintaining a clear “line of sight” from high-level strategy down to each project’s deliverables. By 2025 and beyond, expect strategic roadmapping to become more collaborative and continuous, involving not just PMOs but also business unit heads and the C-suite in an ongoing dialogue. This ensures that the entire portfolio is always aligned with the company’s strategic intent, which is especially crucial in volatile business environments.

- Value-Focused Prioritization and Investment Governance: With economic pressures and limited resources, executives are sharpening their focus on ROI and value delivery from every investment. SPM is evolving to help leadership rigorously prioritize initiatives that maximize business value and support long-term strategy. In practice, this means CFOs and Portfolio Directors are increasingly involved in portfolio decision-making, applying financial metrics and strategic criteria to rank projects. The trend for 2025–2027 is a more disciplined investment governance process at the portfolio level – often facilitated by SPM tools that score initiatives on factors like expected ROI, strategic fit, risk, and resource requirements. A recent McKinsey study highlights that the role of finance leaders is expanding in this area: between 2016 and 2021, the share of CFOs responsible for their companies’ digital investments tripled, with nearly two-thirds of finance leaders now overseeing digital strategy (up from 44% in 2016). mckinsey.com

- Integrated Dependency and Risk Management: As portfolios grow more complex, managing the interdependencies among projects and programs is becoming a critical priority for business leaders. A change or delay in one initiative can have cascading effects on others, especially in large enterprises. From a leadership perspective, the trend is toward greater visibility of cross-project dependencies and proactive risk mitigation at the portfolio level. Senior Portfolio Managers and CIOs are investing in SPM practices that map out how projects intersect (for example, sharing key resources, technologies, or outcomes) so that nothing falls through the cracks. When dependencies are clearly understood, leadership can sequence initiatives more effectively and avoid collisions – such as overallocation of the same expert team or conflicting schedules between projects. Moreover, identifying these relationships helps in risk management: leaders can spot systemic risks (like an over-reliance on a single vendor, or a critical internal bottleneck) that might threaten strategic objectives. Modern SPM platforms increasingly offer dashboards for dependency tracking and risk heatmaps across the portfolio. By 2025, we anticipate that risk and interdependency management will be deeply ingrained in SPM processes – not just as a technical PMO exercise, but as an executive-level concern. Business executives will regularly review inter-project dependencies and risk scenarios as part of strategic planning, ensuring that potential roadblocks to execution are addressed early.

- Resource Capacity Planning and Scenario Analysis: A strategy is only as achievable as the resources behind it. One emerging trend is the use of advanced resource capacity planning and scenario analysis to ensure strategic initiatives are properly resourced. For example, a Director of Information Technology or a Project Portfolio Manager might ask: “Do we have the right talent and capacity to execute our 2026 strategic projects, given our ongoing operational workload?” SPM is evolving to answer such questions by integrating resource management into strategic planning. Leadership teams are turning to scenario planning tools to explore different what-if situations — such as accelerating a major program, pausing a less critical project, or hiring additional talent — and to see the impact of those choices on budgets, timelines, and outcomes. This kind of scenario analysis helps C-level executives make informed trade-off decisions before committing to a course of action. Between 2025 and 2027, expect scenario planning to become a standard feature of strategic portfolio discussions. Whether it’s evaluating how to respond to an economic downturn or how to execute an ambitious transformation, leaders will use SPM software to model various portfolio scenarios (adjusting project sequences, funding levels, and resource allocations) in a sandbox environment. This ensures that when a strategic pivot is needed, it can be done with clear foresight into resource and timing implications. It also gives confidence to the board and the CFO that the chosen strategic portfolio is realistic and achievable with the resources at hand.

- AI-Powered Analytics and Decision Support: The use of advanced analytics and AI in strategic portfolio management is a trend that continues to gain momentum. Business leaders are increasingly seeking data-driven insights to guide their decisions on where to invest and how to optimize their portfolios. AI and machine learning are being applied to analyze project data, forecast outcomes, and even recommend portfolio adjustments. For instance, an AI system might analyze historical project performance and flag which proposed initiatives have the highest risk of delay or cost overrun, helping executives prioritize more effectively. By 2025, we anticipate more widespread adoption of AI-driven portfolio analysis tools among enterprises. In the finance domain, the use of AI and automation tools has already more than tripled since 2018 mckinsey.com– a reflection of growing trust in data-driven decision support at the executive level. In SPM, AI can assist with generating optimized project schedules, detecting patterns (such as consistently overbooked departments or under-utilized budget areas), and providing real-time portfolio health alerts. The innovation here is not just the technology itself, but how it’s used in leadership forums: we expect portfolio review meetings in the near future to routinely include AI-generated insights (for example, predictive project risk scores or benefit forecasts for each initiative under consideration). Ultimately, AI and analytics empower leaders to make more informed, unbiased decisions, turning vast amounts of portfolio data into actionable intelligence. This trend dovetails with the others – enabling truly dynamic roadmaps, smarter prioritization, and proactive risk management – and is a key part of the future of SPM.

Top management wants to ensure that every project in the portfolio earns its place by contributing measurable value. Gartner also projects that by 2027, 75% of organizations will enrich their business architecture by connecting financial benefits to digital investment decisions – a sign of the strong focus on linking investments to strategic value.

In short, executives are treating the project portfolio like a strategic asset, continually reallocating funding to the most valuable initiatives (and trimming those that underperform) in order to truly “put their money where their strategy is.”

How SPM is Evolving to Boost Decisions, Collaboration and Resource Management

The above trends collectively point to a broader evolution in strategic portfolio management: it is becoming a cornerstone of better decision-making, cross-functional collaboration, and efficient resource use in organizations. Business leaders today need to break down silos in order to execute strategy effectively. SPM provides the framework for doing exactly that by integrating information across projects, departments, and even geographic regions.

One notable shift is improved strategic decision-making at the executive level. With modern SPM practices, decisions about initiating, continuing, or stopping projects are increasingly evidence-based. When a leadership team meets to review the portfolio, they now come armed with real-time data on project status, value metrics, and resource capacity. This data-driven approach contrasts with the gut-feel or politics-driven decisions of the past, and the result is that companies can pivot faster and more confidently. For example, if market conditions change suddenly, an enterprise using SPM can quickly identify which lower-priority initiatives to pause and where to reallocate funds – knowing the impact of those changes on the overall portfolio before making them. Such responsiveness is crucial in a world where strategy adjustments can’t wait for annual planning cycles.

Another key development is enhanced collaboration and alignment across the organization. SPM has evolved to be as much about people and process as about projects. It provides transparency that brings together different roles – CIOs, CFOs, line-of-business heads, and PMO leaders – around a single source of truth. When everyone has visibility into how initiatives are progressing and how they tie to strategic goals, it fosters a culture of accountability and teamwork. A recent study highlighted how misalignment between executives and their teams can hinder success: compared to directors, C-level leaders are far more likely to believe the organization is using its portfolio management tools strategically, which often isn’t the case – leading to silos and disconnects businesswire.com

SPM practices address this by facilitating continuous communication and by making strategic priorities clear at every level. For instance, using SPM dashboards, a VP of Strategy can ensure that both IT project managers and business unit leaders see how their work contributes to larger objectives, reducing the risk of disconnects. We are also seeing more frequent strategy review meetings and cross-department portfolio councils that use SPM data to collectively discuss progress and challenges. This collaborative governance model helps break the traditional barrier between strategy formulation and execution.

Resource management has also greatly improved through SPM’s evolution. In the past, even well-formulated strategies could fail simply because the organization didn’t allocate the right people or budget at the right time. Now, thanks to integrated SPM and resource planning, leaders can actively manage and reallocate resources as priorities change. Capacity planning tools within SPM systems highlight resource bottlenecks early, allowing leadership to address shortfalls before they derail projects. Additionally, scenario planning (as noted in the trends above) enables companies to test the feasibility of strategic plans against resource availability. The net effect is that companies become much more adept at executing ambitious strategies without overextending their teams. Notably, organizations that have embraced mature SPM capabilities report significantly higher success rates in delivering strategic initiatives.

These outcomes stem directly from making better decisions, ensuring team alignment, and optimizing resource use – all core aims of modern SPM.

In summary, SPM is shifting from being a project management adjunct to becoming a strategic leadership tool. It’s enabling executives to make tough decisions with clarity, encouraging disparate teams to work together toward strategic goals, and making sure that human and financial capital are deployed where they matter most. Companies that embrace this evolved SPM approach are positioning themselves to execute strategy faster and more effectively than those that stick to siloed planning methods.

What Leaders Need from SPM Tools and Solutions

Given these trends and the growing importance of SPM, what exactly are executives looking for in the tools and solutions that support this process? When we consider the needs of our target audience – whether it’s a CIO, a Head of Portfolio Management, or a CFO – a few clear requirements emerge:

- Real-Time Visibility and Single Source of Truth: Busy executives need instant visibility into the status of strategic initiatives. They want SPM tools that provide intuitive dashboards and consolidated reports, bringing together project data from across the enterprise. This visibility is crucial for making informed decisions. For example, a Director of IT should be able to see at a glance if a critical program is off track or if there’s a resource conflict between two high-priority projects. Leaders also need transparency that extends beyond basic project metrics; they want to understand how each initiative ties back to strategic objectives and what value it is expected to deliver. A single source of truth ensures that in meetings, everyone from the Portfolio Analyst up to the CFO is looking at the same up-to-date information. This avoids the common problem of debating whose spreadsheet is correct and instead shifts the focus to solving problems. In essence, high-quality SPM tools offer an executive “cockpit” with full portfolio visibility – something increasingly seen not just as nice-to-have, but as essential. It’s telling that Forrester predicts 72% of organizations say they plan to increase investment in portfolio management solutions in the next 24 months, with a priority on integrating strategic planning capabilities. That reflects a broad push for more visible and connected portfolio oversight at the leadership level.

- Scenario Planning and Forecasting Capabilities: Modern strategic portfolios must be managed not only by looking at the present, but also by anticipating the future. Leaders require tools that enable robust scenario planning, forecasting, and “what if” modeling. For instance, a Head of Strategy might want to model the impact of a 10% budget cut across all initiatives, or a CIO might simulate the timeline implications of adding a new high-priority project next quarter. SPM solutions need to support this kind of analysis seamlessly. The ability to create and compare multiple scenarios helps executives stress-test their strategic plans against uncertainties (like economic downturns, supply chain disruptions, or shifts in corporate priorities) and develop contingency plans. Importantly, scenario planning is not just about risk avoidance; it’s also about seizing opportunities. With the right tool, leadership can identify an alternative portfolio mix that yields higher ROI or faster innovation, and then have data to back up that decision. This aligns with the evolving role of SPM as a strategic enabler – it’s not only tracking what’s happening, but also guiding where things could head. As noted earlier, many organizations are actively seeking to better integrate strategic planning with portfolio management businesswire.com, indicating that scenario-planning features will be high on the wish list when selecting SPM software.

- Robust Financial Metrics and Value Tracking: Since strategic portfolio management sits at the intersection of strategy and execution, it also intersects heavily with finance. CFOs and other finance executives need SPM tools to bring financial rigor into portfolio decisions. This means having capabilities for budgeting, investment tracking, and benefits realization. Leaders want to see, for each strategic initiative, not just the cost and budget status, but also the expected value or returns (such as projected revenue impact, cost savings, or other key KPIs). In the future of SPM, we see a closer coupling of portfolio management with enterprise financial management. For example, a platform might allow the CFO to allocate funding to strategic themes (like “Digital Customer Experience” or “Operational Efficiency”) and then track how projects under those themes are performing in financial terms. Key financial metrics such as NPV (Net Present Value), IRR (Internal Rate of Return), and realized ROI should be traceable at both the project and portfolio level. The overarching point is that SPM solutions must speak the language of business value. A system that ties dollars invested to dollars (or other units of value) returned is incredibly powerful for the C-suite. It enables a continuous feedback loop where strategy can be adjusted based on real performance data. With finance leaders now more involved in digital initiatives and project portfolios than ever mckinsey.com, having strong financial analytics in SPM tools is a must. Indeed, Gartner’s prediction that by 2027 most companies will be linking financial benefits to their digital investments underscores this need.

In practical terms, this means a CFO should be able to use the SPM platform to monitor, in real time, the total investment in strategic initiatives and the measurable returns those initiatives are delivering – and to course-correct if the numbers fall short.

In addition to the above priorities, business leaders also value user-friendly interfaces (since an SPM platform will be used by diverse stakeholders), integration capabilities (to pull data from project management systems, ERP, HR databases, etc.), and support for the frameworks they use (whether that’s OKRs, Balanced Scorecard, or specific governance workflows). However, visibility, scenario planning, and value tracking remain at the top of the list because they directly enable the leadership team to guide the organization effectively.

Conclusion: Driving Strategy Forward with Modern SPM

Strategic portfolio management is no longer just the domain of the project management office – it has become a critical function on the agenda of CEOs and executive teams. The future of SPM in 2025–2027 is about being more agile, data-driven, and value-focused in how companies select and execute their strategic initiatives. Business leaders are calling for better roadmaps, sharper prioritization, integrated dependency oversight, proactive resource planning, and intelligent insights. The organizations that rise to these challenges will be the ones that consistently turn strategy into results, even amid uncertainty.

The good news is that technology and best practices are evolving quickly to support these needs. Solutions like Keto AI+ are at the forefront of this evolution. Keto AI+ is a Strategic Portfolio Management platform designed to give leadership teams exactly what we’ve outlined: it provides end-to-end visibility into your portfolio, powerful scenario-planning tools, and built-in financial metrics to tie every project to business outcomes. For example, Keto AI+ uses advanced analytics to help identify priority conflicts or resource bottlenecks before they become issues, and its roadmapping and dependency visualization features ensure that everyone – from the CIO to individual project owners – understands how initiatives align with strategic goals. With Keto AI+, a CFO can monitor the ROI of the project portfolio in real time, while a Head of Strategy can model different investment scenarios on the fly.

In essence, Keto AI+ helps operationalize the trends and best practices discussed in this article. It acts as the connective tissue between strategy formulation and execution, augmented by AI-driven insights and a user-friendly interface tailored for enterprise needs. If your leadership team is looking to strengthen strategic portfolio management and ensure your investments truly drive value, Keto AI+ offers a compelling solution.

Ready to see it in action? We invite you to learn how Keto AI+ can support your organization’s strategic goals. Book a demo with our team to discover how better portfolio visibility, smarter prioritization, and real-time insights can elevate your strategy execution. The future of strategic portfolio management is here – and with the right tools and processes, you can lead your organization to new heights of strategic success.

Read next