Manage ESG Compliance with Keto AI+ Platform

Environmental, Social, and Governance (ESG) initiatives have evolved from a compliance checkbox to a central pillar of enterprise strategy. For today’s CIOs, CFOs, and Heads of Strategy, ESG goals stand alongside ROI, risk, and resource efficiency as top-level metrics driving decision-making. In fact, modern “value-driven” portfolio decisions now look beyond short-term financials to include intangible benefits like ESG contributions, ensuring more sustainable and impactful outcomes. This shift is fueled by stakeholder expectations – investors increasingly view strong ESG performance as a sign of lower risk and long-term resilience – and by emerging regulations that demand rigorous sustainability reporting.

ESG as a Strategic Portfolio Pillar

Leading organizations worldwide are embedding ESG objectives directly into their Strategic Portfolio Management (SPM) practices. Rather than treating ESG as a standalone effort or afterthought, they establish dedicated ESG programs and initiatives within their portfolio of strategic projects. These ESG programs are managed with the same rigor as any major business objective, complete with budgets, KPIs, and executive sponsors. The rationale is clear: climate impact, social responsibility, and good governance are now mission-critical outcomes that drive competitive advantage and risk mitigation.

By elevating ESG to a strategic pillar, companies can pursue goals such as:

-

Carbon Neutrality – e.g. transitioning operations to achieve net-zero emissions by a target year.

-

Social Impact & Equity – improving diversity and community engagement, or ensuring fair labor practices across the supply chain.

-

Governance & Compliance – strengthening data privacy, ethical governance, and transparency in reporting.

Managing these ambitions requires robust oversight. Just as financial ROI or risk profiles guide project selection, ESG criteria must be embedded into portfolio governance. This means that when executives prioritize initiatives, a project’s contribution to sustainability or social value should weigh on decisions at the same level as its cost or return. For instance, if two projects have similar ROI, but one significantly advances a carbon reduction goal, that factor can tip the scales. Progressive organizations use SPM frameworks to formalize this, ensuring ESG-driven trade-offs are made consciously in line with corporate strategy.

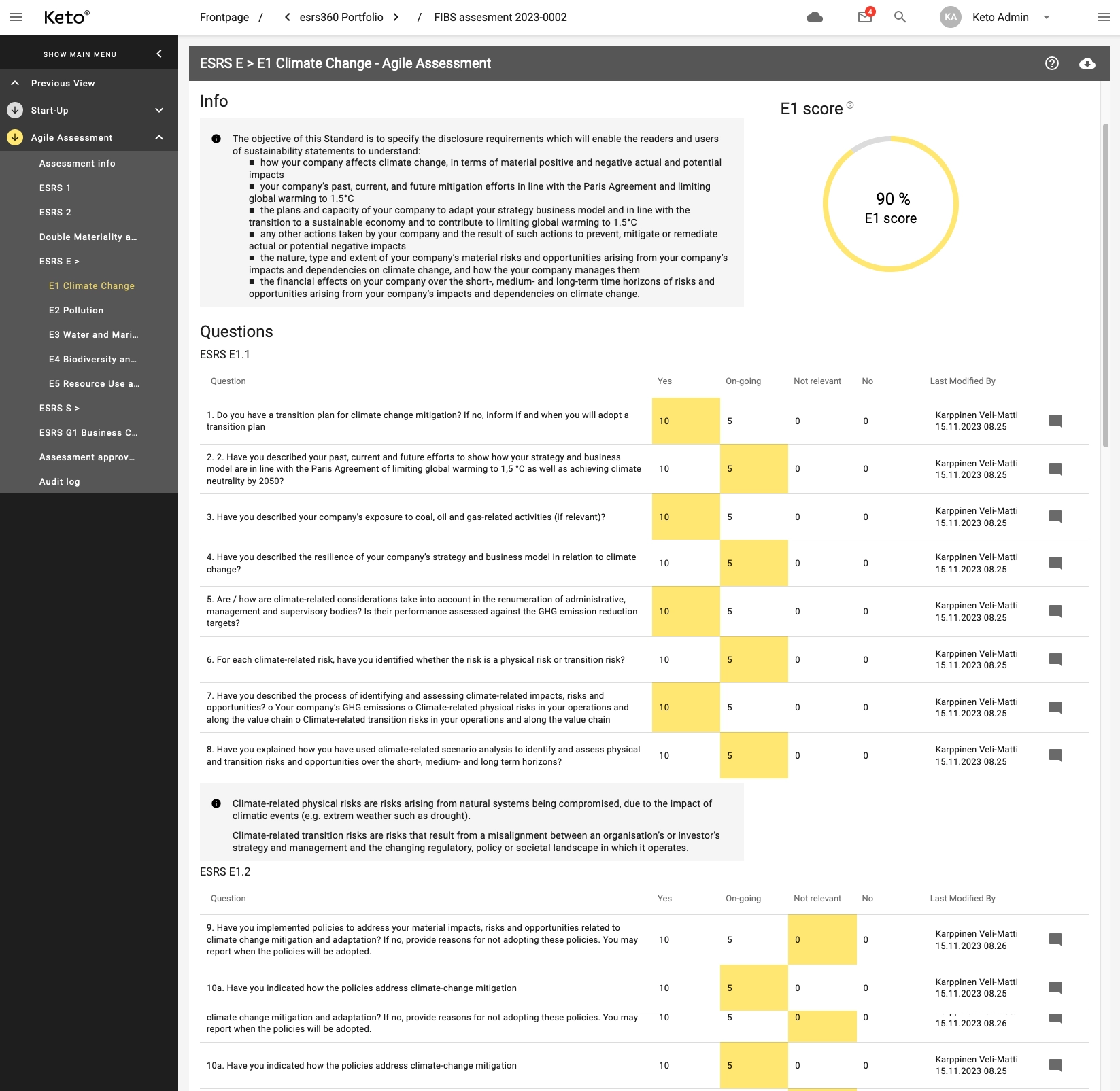

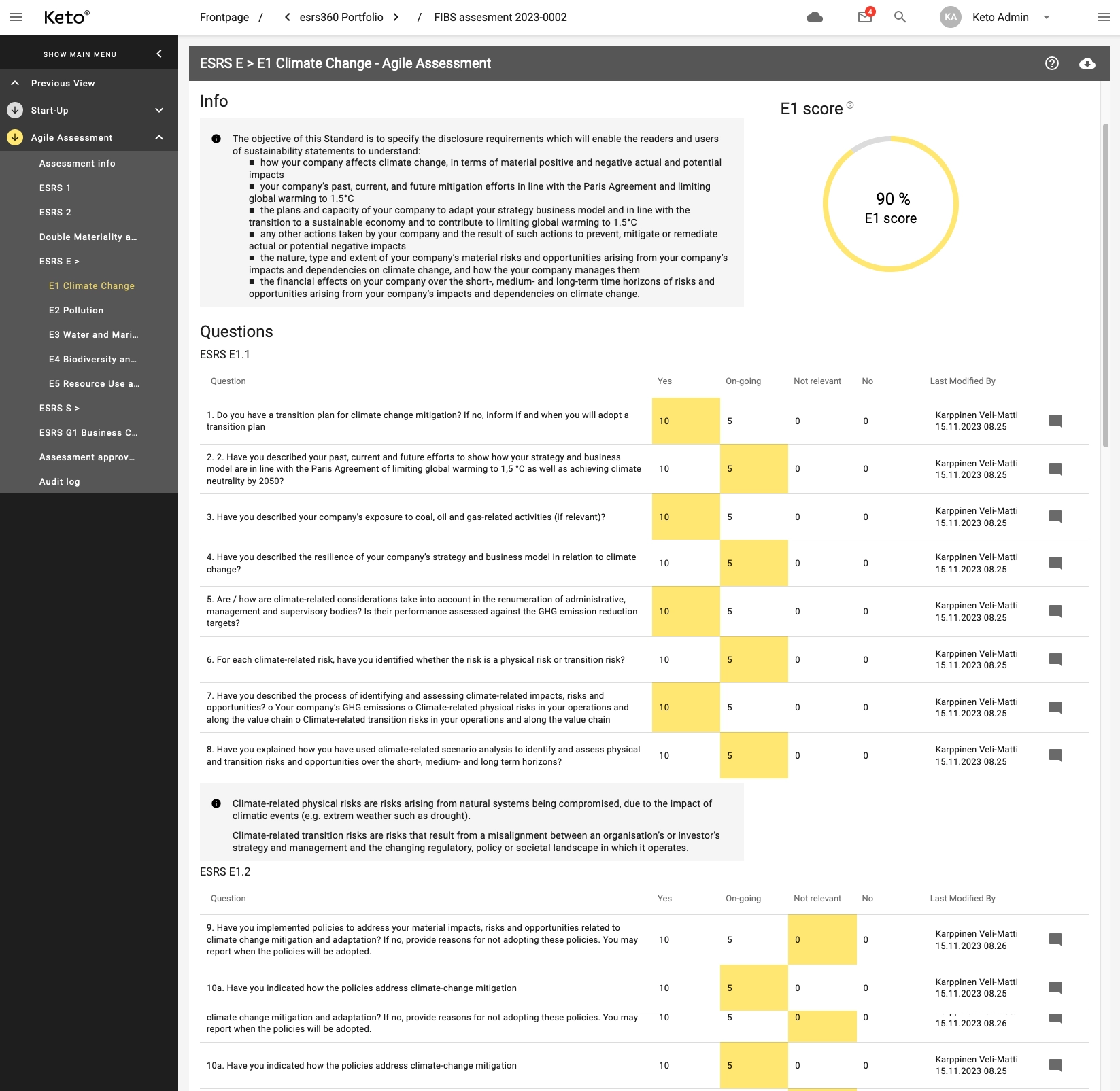

Open larger image here.

Integrating ESG into Strategic Planning and Execution

In practice, integrating ESG into strategic planning involves aligning high-level sustainability goals with concrete projects and outcomes. This starts at ideation: when new initiatives are proposed, their alignment to ESG objectives is documented and evaluated. Many enterprises adopt Objectives and Key Results (OKRs) to connect strategy with execution. Using OKRs, one can set specific ESG objectives (for example, “Reduce greenhouse gas emissions by 30% within 5 years”) and tie them to key results and projects. The Keto AI+ Platform supports this approach by allowing teams to define ESG goals in the platform’s OKR module and link them to initiatives. This ensures that every project in the portfolio can be measured not only by traditional metrics, but also by its contribution to ESG targets.

Once ESG objectives are baked into planning, the portfolio execution process keeps them on track. ESG-focused initiatives may span multiple departments – from IT infrastructure upgrades for energy efficiency, to HR programs for diversity and inclusion – so having a unified platform is crucial. Strategic Portfolio Management software like Keto provides a single source of truth where all ESG project data, KPIs, and risks are centralized. This enables cross-functional visibility: a CFO can see how sustainability projects impact financial forecasts, while a Head of Strategy can ensure ESG programs remain aligned with long-term roadmaps. It also means ESG becomes part of the conversation in every portfolio review, rather than a separate silo.

How Keto AI+ Platform Empowers ESG in SPM

Keto’s AI+ Platform is purpose-built to help enterprises integrate ESG into their portfolio management seamlessly. It offers a flexible, no-code environment to adapt to any industry’s ESG priorities while maintaining robust strategic oversight. Below are key capabilities of the Keto AI+ Platform that enable ESG to be treated as a first-class strategic objective:

-

Define ESG Programs and Goals with Ease: Keto allows you to set up dedicated ESG programs or themes within your portfolio, each with its own set of projects and KPIs. You can establish company-specific ESG objectives (for example, emission reduction, societal impact, governance improvements) and link them to relevant initiatives. The platform’s support for OKRs means you can align these ESG programs with measurable key results and track progress transparently. This ensures ESG goals are not vague promises but well-defined initiatives visible to all stakeholders. Moreover, Keto’s no-code configurability lets you customize workflows or data fields to capture the exact ESG metrics and compliance information your organization needs – without any coding. This flexibility is critical for tailoring the system to frameworks or standards your company follows.

-

ESG-Based Portfolio Scoring and Prioritization: Making ESG a part of decision-making is easy with Keto’s advanced prioritization tools. The platform enables multi-criteria scoring models where ESG impact can be weighted alongside financial returns, strategic fit, risk level, and resource requirements. Portfolio managers and steering committees can evaluate proposals using customized scorecards that include ESG criteria – for example, assigning points for carbon footprint reduction, community benefit, or governance improvements. Keto’s what-if analysis features allow executives to simulate different portfolio scenarios and see how emphasizing ESG changes the project rankings. This helps answer questions like: “If we give more priority to sustainability, which initiatives rise to the top?” By quantifying ESG value in this way, organizations ensure that high-impact sustainability projects get the attention and funding they deserve. In short, Keto provides the tooling to treat ESG investments with the same analytical rigor as any other business investment, aligning project selection with the company’s values and long-term vision.

-

Real-Time ESG Performance Tracking: With Keto AI+ Platform, tracking the progress of ESG initiatives is as immediate and data-driven as tracking financial metrics. Interactive dashboards and AI-driven analytics give leaders instant insight into how ESG programs are advancing. You can monitor live KPIs – such as energy usage reductions, CSR engagement levels, or compliance task completion – through visual charts and reports updated in real time. This level of visibility means that if an ESG project is falling behind (say a delay in a renewable energy rollout) or if a risk arises (such as a new regulatory requirement), decision-makers see it and can respond promptly. Keto also integrates portfolio status views (like Kanban boards and timeline roadmaps) that include ESG projects, ensuring they are reviewed in the same cadence and context as other initiatives. As one customer attests, after implementing Keto they were able to “track and measure [projects] transparently and in real-time” across their portfolio. This kind of up-to-the-minute insight is invaluable for executives balancing multiple strategic goals – it enables proactive course correction and continuous alignment with ESG targets throughout execution.

Driving Strategy and Sustainability Hand in Hand

By leveraging Keto AI+ Platform to manage ESG as a core part of strategic portfolio management, organizations can ensure that sustainability is woven into the fabric of business execution. The benefit-oriented approach means that every ESG initiative is aligned with strategic outcomes – whether that’s enhancing brand reputation, reducing long-term costs through efficiency, or mitigating risks like regulatory penalties. CIOs and CFOs find value in how this integration streamlines decision-making: trade-offs between profit and purpose become clearer, and often, synergies emerge (for example, a project that cuts carbon emissions might also reduce energy costs, delivering ROI and ESG benefits simultaneously).

Equally important, this approach provides visibility and accountability. Top leadership can track ESG progress with the same rigor as financial performance, ensuring that sustainability commitments made in board rooms translate to tangible actions on the ground. Program sponsors can prioritize resources for ESG programs even amid tight budgets, knowing that these efforts drive long-term value creation. In fact, companies using Keto have successfully launched and managed enterprise-wide ESG programs. For instance, a global packaging firm set an ambitious goal to become carbon-neutral by 2025 and managed its sustainability R&D portfolio through Keto. Across industries, from manufacturing to energy, organizations are seeing how integrating ESG into SPM brings coherence – uniting people, planet, and profit objectives under one execution framework.

In conclusion, treating ESG as a major strategic objective is no longer optional – it’s a business imperative. With the Keto AI+ Platform, you have a powerful ally to turn ESG strategy into action. It enables you to prioritize what matters, invest in initiatives that align with your values and stakeholder expectations, and confidently navigate the new era of sustainability-focused management. By making ESG an intrinsic part of portfolio management, you position your enterprise for responsible growth, resilience, and a reputation of leadership in the market. Together, strategy and sustainability drive forward in lockstep – delivering not only financial returns, but also positive impacts that resonate with employees, customers, investors, and society at large. With Keto, you can execute on ESG goals with the same agility and intelligence that you apply to any business goal, ensuring that your portfolio delivers value for the business and the world it operates in.

Read next