Understanding Risk Management: A Crucial Component in Strategic Portfolio Management

Risk management is the cornerstone of any successful business operation. This systematic process involves identifying, evaluating, and strategising ways to mitigate potential threats to an organisation's ability to achieve its objectives. These threats, or risks, can arise from a variety of sources, including strategic management decisions, operational inefficiencies, financial instability, technological disruptions, legal liabilities, and even natural disasters. The ultimate goal of risk management is to control these risks, reducing their potential negative impacts while simultaneously leveraging opportunities to improve business outcomes.

Risk Identification and Analysis: Laying the Groundwork

The first step in the risk management process is risk identification. This involves recognising potential risk factors that could negatively impact an organisation’s objectives. These risks can stem from internal sources, such as operational inefficiencies, or external sources, like market volatility or legislative changes.

Following risk identification, risk analysis takes centre stage. This stage involves a thorough understanding of the likelihood and potential impact of each identified risk. Risk analysis could employ quantitative or qualitative methods, depending on the nature of the risk and the available data.

Risk Assessment and Risk Evaluation: The Critical Interplay

Risk assessment is the critical next step, forming the bridge between risk identification and risk management. It involves integrating the outputs of risk identification and risk analysis to ascertain the overall significance of each identified risk. This process takes into consideration the likelihood of each risk event’s occurrence and the severity of its potential impact.

Risk evaluation, meanwhile, prioritises the identified risks based on their significance, paving the way for the implementation of appropriate risk control measures. This step necessitates a keen understanding of the organisation’s risk appetite, i.e., the level of risk it is willing to accept in pursuit of its goals.

Steering Risk Control and Mitigation: The Pillars of Risk Management

Risk control and mitigation form the backbone of risk management. Once risks have been prioritised through the risk evaluation process, the organisation implements suitable control measures. The choice of control measures often depends on the organisation’s risk tolerance and could involve risk avoidance, risk reduction, risk transfer, or risk retention strategies.

Risk mitigation strategies are designed to lessen the potential impacts of risks. These strategies can include developing a risk register to monitor and track risks, implementing risk reduction techniques to lessen the likelihood or impact of risks, or establishing contingency plans to manage risks that materialise.

The Dynamics of Risk Appetite and Risk Tolerance

Every organisation must define its risk appetite and risk tolerance as part of its risk management strategy. The risk appetite is the amount of risk an organisation is willing to accept or retain in pursuit of its strategic objectives. Risk tolerance, on the other hand, is the degree of variability in investment outcomes that an organisation is willing to withstand.

The Paradigm of Enterprise Risk Management

Enterprise Risk Management (ERM) is a holistic approach that encompasses the management of all types of risks – strategic, operational, and financial. ERM helps organisations identify, assess, manage, and control risks across the entire enterprise, promoting a proactive risk management culture.

Risk Management within the Lens of Strategic Portfolio Management

Risk management plays a pivotal role in Strategic Portfolio Management (SPM). By integrating risk management into SPM, organisations can make more informed decisions about their project investments by considering potential risks and their impacts on overall strategic objectives.

Within SPM, each project or program is viewed as an individual investment with its unique risk and return profile. Through effective risk management, organisations can ensure that these investments align with their overall risk appetite, thereby driving more predictable, risk-adjusted returns. This alignment is crucial to maximising the ROI of the project portfolio and achieving the organisation’s strategic objectives.

Introducing the Keto AI+ Platform: Revolutionising Risk Management

In today’s digital age, the nexus between advanced technology and risk management is ineluctable. As organisations traverse the complex terrains of risk, they increasingly lean on innovative platforms to offer them comprehensive insights, agility, and efficiency. One such avant-garde platform that has emerged as a beacon of hope in the risk management arena is the Keto AI+ platform.

At its core, Keto AI+ is a sophisticated platform underpinned by the power of artificial intelligence and machine learning. It offers organisations a holistic, integrated suite of tools designed to not only identify and assess risks but also predict and respond to them in real-time.

By sifting through historical data and juxtaposing it with current operational metrics, Keto AI+ can forecast potential risk events. Such predictive analytics allow organisations to be proactive rather than reactive, shifting the paradigm from risk mitigation to risk prevention.

Furthermore, with its real-time monitoring system, Keto AI+ keeps a vigilant eye on all operational touchpoints, sending out immediate alerts if any metric deviates from expected thresholds. This ensures that potential risks are promptly addressed, further fortifying the organisation’s risk management approach.

When integrated with Strategic Portfolio Management (SPM) via the Keto AI+ platform, risk management assumes a more strategic role. This synergy ensures every project or initiative within the portfolio is evaluated not only for its potential returns but also its risk profile, driving more balanced, well-informed decisions aligned with the organisation’s broader objectives.

Risk Management – The Pathway to Business Resilience

In a rapidly evolving business landscape, characterised by technological disruptions and increasing regulatory complexities, risk management is not just about problem prevention; it’s about creating a resilient organisation that can adapt and thrive amid uncertainty. This resilience stems from a robust risk management framework, enabling informed decision-making, enhancing stakeholder confidence, and improving overall organisational agility.

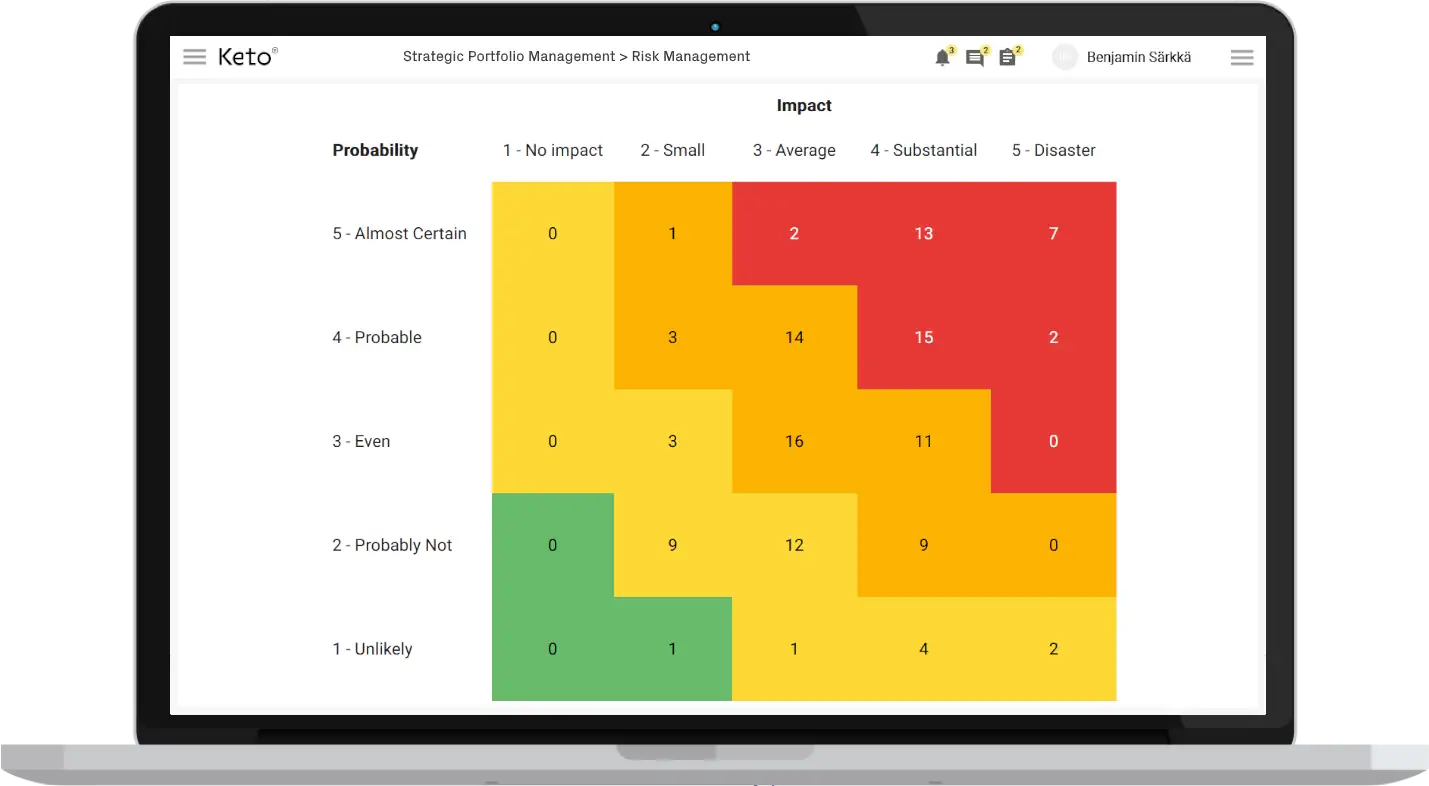

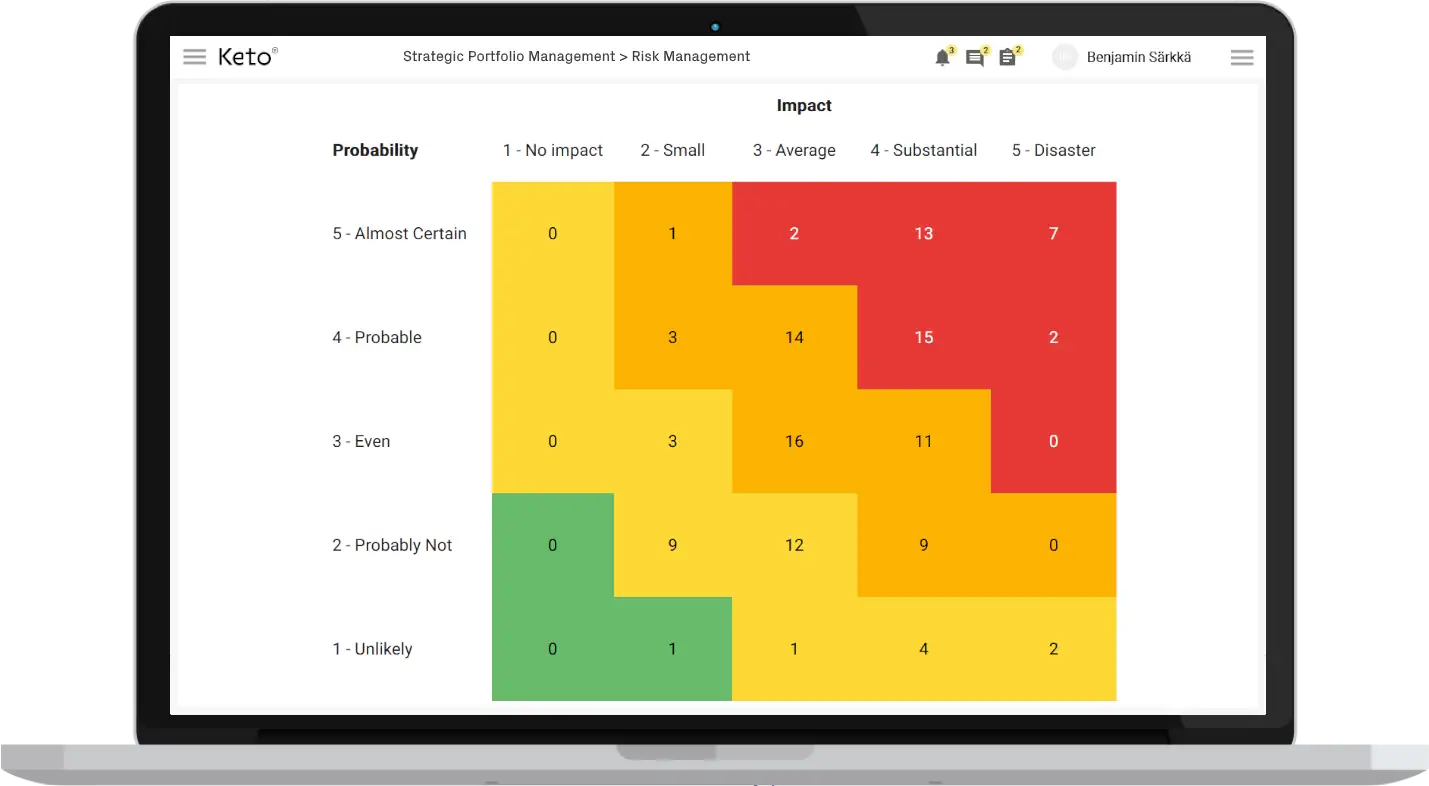

Moreover, with specialised risk management software, organisations can automate and streamline their risk management processes, driving efficiency and enabling real-time risk monitoring and reporting. Tools like risk dashboards provide a clear, consolidated view of risk exposure across the organisation, supporting effective risk governance.

Conclusion: Risk Management – A Key Driver of Strategic Portfolio Management

In conclusion, risk management forms an integral part of Strategic Portfolio Management (SPM). By proactively identifying, assessing, controlling, and mitigating risks, organisations can ensure the strategic alignment of their project portfolio, drive informed decision-making, and optimise resource allocation. By integrating risk management into SPM, organisations can strike a balance between risk and reward, driving sustainable growth and long-term business success.

Remember, the goal of risk management within SPM is not to eliminate risk entirely but to manage it effectively. After all, in the words of former world chess champion Garry Kasparov, “The biggest risk is not taking any risk.”

Read next