Strategic Portfolio Risk Management: Ensuring Strategy Execution Success

In today’s volatile business environment, effective risk management is a cornerstone of strategic execution. PMO leaders, CIOs, and risk officers know that even the boldest strategy can fail if risks go unmanaged. In fact, nearly half of organizations fail to meet even half of their strategic targets – a staggering figure often linked to unforeseen obstacles and poor risk oversight. Similarly, Gartner reports that 53% of digital initiatives fall short of intended results, underscoring how critical it is to identify and mitigate risks before they derail key programs. By embracing a proactive, portfolio-level approach to risk management, organizations can safeguard strategy execution and keep their project portfolios on track to deliver value.

What Is Risk Management in Strategic Portfolio Management (SPM)?

Risk management is a systematic process of identifying, evaluating, and addressing potential threats to an organization’s objectives. These threats (or “risks”) may stem from internal issues like execution delays or capacity shortfalls, as well as external events like market shifts or regulatory changes. The goal isn’t to eliminate all risk – which is impossible – but to control exposure within the organization’s risk appetite and improve the predictability of outcomes. As PMI notes, using a structured risk management practice is a significant driver of project success pmi.org. In the context of Strategic Portfolio Management (SPM), this means managing risks not just within individual projects, but across the entire portfolio of initiatives to ensure they collectively support the organization’s strategic goals.

Key components of the risk management process include:

- Risk Identification: Pinpointing potential events or conditions that could threaten strategic initiatives. For example, identifying if a critical project depends on a single vendor (supply risk) or if changing market trends could render an initiative obsolete.

- Risk Analysis & Evaluation: Assessing the likelihood and impact of each identified risk. This involves determining how probable a risk event is and how severely it could affect portfolio objectives if it occurs. High-likelihood or high-impact risks receive higher priority. The organization’s risk appetite (the level of risk it is willing to accept in pursuit of strategy) and risk tolerance (acceptable variance in outcomes) guide this prioritization.

- Risk Mitigation Planning: Developing response strategies for top-priority risks. Common approaches include avoiding the risk (changing plans to eliminate the threat), reducing the risk (taking action to minimize impact or probability), transferring the risk (e.g. outsourcing or insuring against it), or accepting the risk (acknowledging it and preparing a contingency). The chosen mitigation should align with the organization’s risk tolerance and strategic priorities.

- Risk Monitoring & Control: Continuously tracking identified risks and scanning for new ones throughout initiative execution. This includes updating risk status, reviewing early warning indicators, and adjusting plans as needed. Ongoing monitoring ensures that risk responses remain effective and that emerging threats don’t go unnoticed.

By embedding these practices into portfolio governance, leaders can make risk-informed decisions at every stage. As McKinsey observes, many companies historically left risk management to individual projects with “insufficient executive guidance,” meaning critical risks that “should be managed at the portfolio level” often remain hidden in project silos mckinsey.com. An SPM-oriented risk approach brings those risks into the open, enabling enterprise leaders to address threats to strategic objectives before they escalate.

Risks That Threaten Strategy and Portfolio Performance

Even the best-formulated strategy can be knocked off course by a range of risks. Let’s look at some of the most common portfolio-level risks that can undermine strategy execution:

- Initiative Failure or Underperformance: When major projects or programs fail to deliver expected benefits, the entire strategy suffers. This could be due to technical challenges, scope creep, or unmet requirements. High failure rates – such as the 53% of digital initiatives not achieving goals gartner.com – show how frequently this risk materializes. Without portfolio-level visibility, such failing initiatives might continue consuming resources long after their strategic value is in question.

- Misaligned Investments: Organizations often invest in projects that sound promising individually but don’t align with top-level strategic priorities. This misalignment is a risk in itself – it diverts finite resources away from what matters most. For instance, one analysis showed 48% of organizations mismanage strategy execution to the point of missing most of their targets. A classic example is a company over-investing in a legacy product while market demand shifts elsewhere. Portfolio risk management helps prevent strategic missteps by ensuring every initiative is weighed against strategic objectives and risk-adjusted returns.

- Delivery Delays and Dependencies: Delays in one initiative can cascade across a portfolio – especially when projects have interdependencies. A late software module, for example, might stall multiple product launches. These schedule risks threaten time-to-market and can erode competitive advantage. Capacity bottlenecks often underlie such delays: if too many high-priority projects overlap, teams and resources get overextended. Identifying this risk at the portfolio level allows leaders to stagger projects or add capacity before bottlenecks choke execution.

- Resource and Capacity Risks: Even if projects are well aligned, overleveraged resources and inaccurate capacity planning pose serious risks. Overcommitting teams or funding beyond what the organization can realistically handle leads to burnout, quality issues, or abrupt project cancellations. Forrester’s research on SPM tools highlights the importance of surfacing overextended resources and execution requirements alongside risks to avoid overloading the portfolio. Balancing the portfolio’s demand against the organization’s delivery capacity is crucial to avoid systemic failure.

- External and Strategic Risks: At the portfolio level, leaders must also consider external uncertainties – macroeconomic shifts, regulatory changes, supply chain disruptions, or competitive moves. These strategic risks can affect multiple initiatives at once. As one McKinsey study noted, organizations are increasingly “weaving risk into long-term strategy development” and building resilience for a dynamic operating environment mckinsey.com. A strategic risk like a sudden market downturn might force reprioritization of the project portfolio; only a risk-aware organization can respond in stride rather than in panic.

By viewing risk holistically across the portfolio, executives and PMOs can see the big picture of risk exposure. This enables them to allocate funds and attention to where the greatest strategic threats lie. It also prevents the common pitfall of local optimization – for example, project managers firefighting their project risks in isolation, while higher-level dangers (like a portfolio-wide funding shortfall or talent shortage) go unaddressed. Integrated risk governance ensures that risk at the project, program, and portfolio levels is managed in concert, not in silos.

Early Risk Identification and Continuous Monitoring

To manage strategic risks, early identification and continuous monitoring are absolutely critical. It’s not enough to draft a risk register at the planning phase and file it away; organizations must treat risk management as a living process. Leading companies foster a culture of vigilance, where project data and environmental signals are constantly analyzed for warning signs. This proactive stance transforms risk management from a one-time assessment into an ongoing radar system for the enterprise.

Modern technology greatly aids this effort. Real-time dashboards and automated alerts can shine a light on developing issues long before they escalate. For example, a risk dashboard might track key risk indicators such as schedule slippage, budget variance, team workload, or market indices – updating continuously as new data comes in. If any metric deviates beyond a defined threshold, the system flags it. According to a Forrester study, there is a “clear and pressing need for real-time…alerts for effective enterprise risk management and business resilience”. In practice, this means that as soon as a critical project starts trending off course or an external threat emerges, the right people get notified immediately.

Such continuous monitoring enables a shift from reactive to proactive risk management. Instead of discovering in a quarterly review that a portfolio initiative is in trouble, executives can get ahead of it. They might see, for example, that two months in a row of staff overtime signal a capacity problem, or that a spike in raw material prices threatens a product launch. With timely insight, they can course-correct – reallocate resources, adjust scope, or initiate contingency plans – before the situation becomes a full-blown crisis.

It’s also important to regularly re-assess known risks. The impact or likelihood of a risk can change over time as projects evolve or external conditions shift. Effective PMOs schedule periodic risk reviews (e.g. monthly or at stage gates) to update risk status and ensure response plans are still adequate. This agility in risk management is part of what makes an organization resilient. As McKinsey research found during the pandemic, companies that built strong risk and resilience capabilities were far better at weathering disruptions and adapting to change mckinsey.com mckinsey.com.

In sum, “what gets monitored, gets managed.” By investing in tools and processes for continuous risk monitoring, organizations gain an earlier line of sight into problems lurking on the horizon. Early warnings empower leaders to tackle issues while they’re still manageable – protecting the portfolio’s strategic outcomes and avoiding costly firefighting down the road.

Mitigation Strategies and Scenario Planning

Identifying a risk is only half the battle; the other half is deciding what to do about it. Risk mitigation strategies should be planned in advance for significant risks, so that the team isn’t scrambling to react when a threat materializes. As noted earlier, typical responses include:

- Avoiding the risk by changing the plan or scope to eliminate the threat (for example, cancelling a high-risk project or choosing a safer supplier).

- Reducing the risk likelihood or impact through specific actions (for example, adding extra testing to reduce quality risk, or training staff to reduce execution risk).

- Transferring the risk to a third party who is better equipped to handle it (for example, outsourcing a complex module, or purchasing insurance for financial risks).

- Accepting the risk consciously and setting aside a contingency reserve or backup plan (for example, budgeting extra time in case of delays).

The right mitigation depends on the risk’s nature and the organization’s risk appetite. Prioritization is key – you can’t (and shouldn’t) throw resources at every conceivable risk. Focus on the “vital few” risks that truly endanger strategic objectives or have a high probability of occurring. For lower-priority risks, a lightweight response or simply monitoring might suffice. The goal is to economically balance risk and reward, not to drive risk to zero at all costs.

Beyond individual risk responses, portfolio leaders should employ scenario planning as a powerful technique to prepare for uncertainty. Scenario planning (or scenario modeling) involves asking “What if?” and simulating different future conditions to see how the portfolio would hold up. For example, leaders might model scenarios such as What if Project A slips by 3 months? or What if market demand drops 15% next quarter? or What if we suddenly lost 20% of our IT workforce? By modeling these hypotheticals, organizations can gauge the impact on strategic timelines, financial targets, and resource plans before such events happen.

This kind of risk scenario modeling is immensely valuable in Strategic Portfolio Management. It allows decision-makers to test the portfolio’s resilience and identify which initiatives or assumptions are most sensitive to shocks. If one scenario shows an unacceptably high impact (say, a critical product launch would fail if a single project slips), that’s a signal to build contingency plans or re-prioritize now. Perhaps additional buffer time can be built into schedules, or alternative suppliers qualified, or a “Plan B” project accelerated in case the primary initiative falters. Scenario analysis basically gives executives a rehearsal for crisis – so if and when it happens, they aren’t caught flat-footed.

Research by leading consultancies reinforces this approach. Gartner emphasizes involving functional leaders in scenario planning to drive both immediate actions and longer-term plans gartner.com.au. McKinsey likewise advocates a forward-looking, resilient stance on risk management – treating it as a strategic capability rather than a mere defensive exercise mckinsey.com mckinsey.com. By preparing for multiple outcomes, organizations can adapt more quickly when reality unfolds differently than expected.

In practice, mitigation and scenario planning go hand in hand. For each major risk or scenario, the team formulates a response: “If X happens, we will do Y.” These response plans should be integrated into portfolio governance. Some may never be needed, but having them in place reduces reaction time dramatically if issues arise. It also builds confidence among stakeholders (executives, board members, investors) that the organization is ready to handle surprises – a key aspect of governance and fiduciary responsibility in strategy execution.

How Keto AI+ Supports Proactive Risk Management

The complexity of managing risk across a strategic portfolio can be daunting – but modern SPM platforms like Keto AI+ are transforming how organizations tackle this challenge. Keto AI+ is a Strategic Portfolio Management platform that leverages advanced analytics and AI to help leaders identify, monitor, and mitigate risks in real time across their project portfolio.

Here are a few ways the Keto AI+ Platform enables proactive risk management:

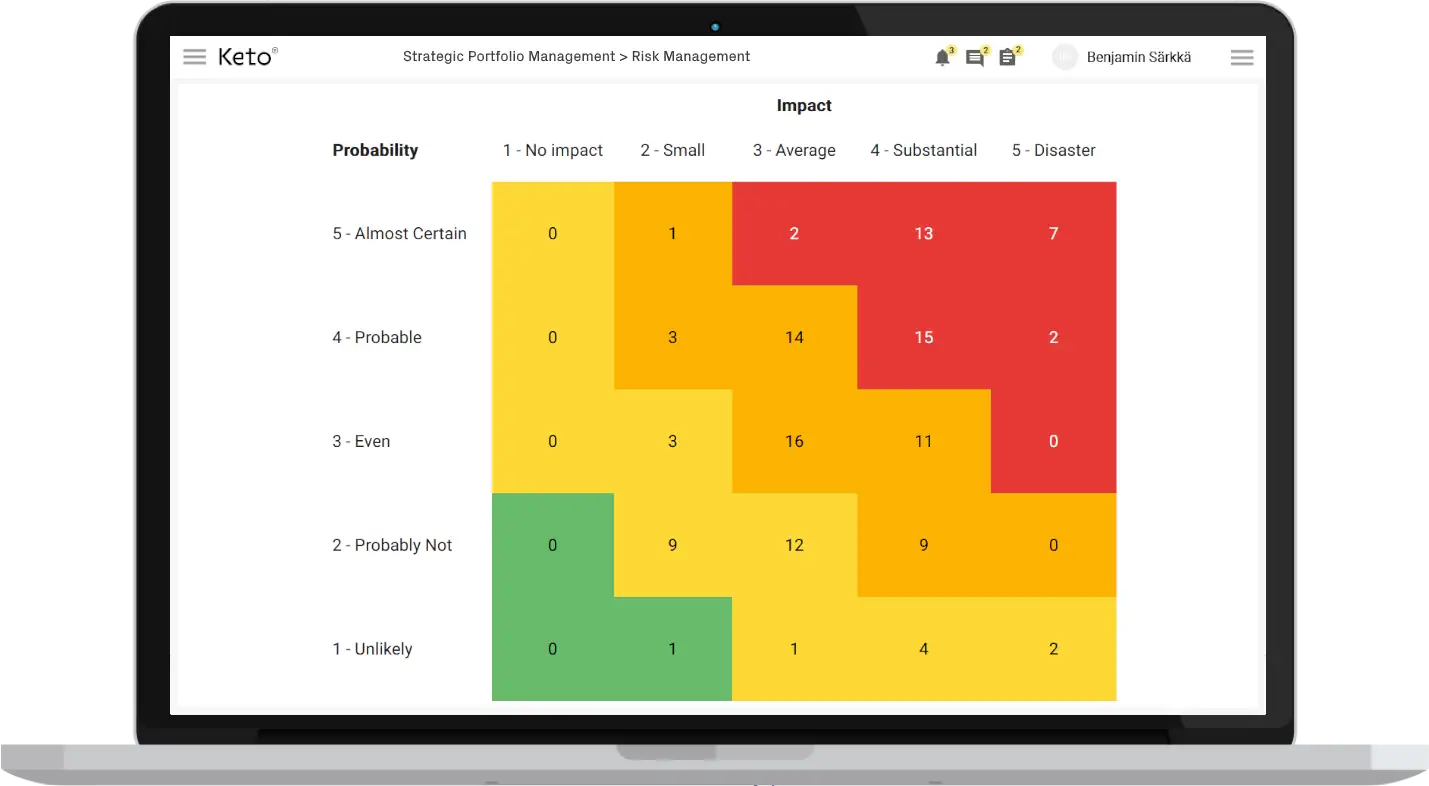

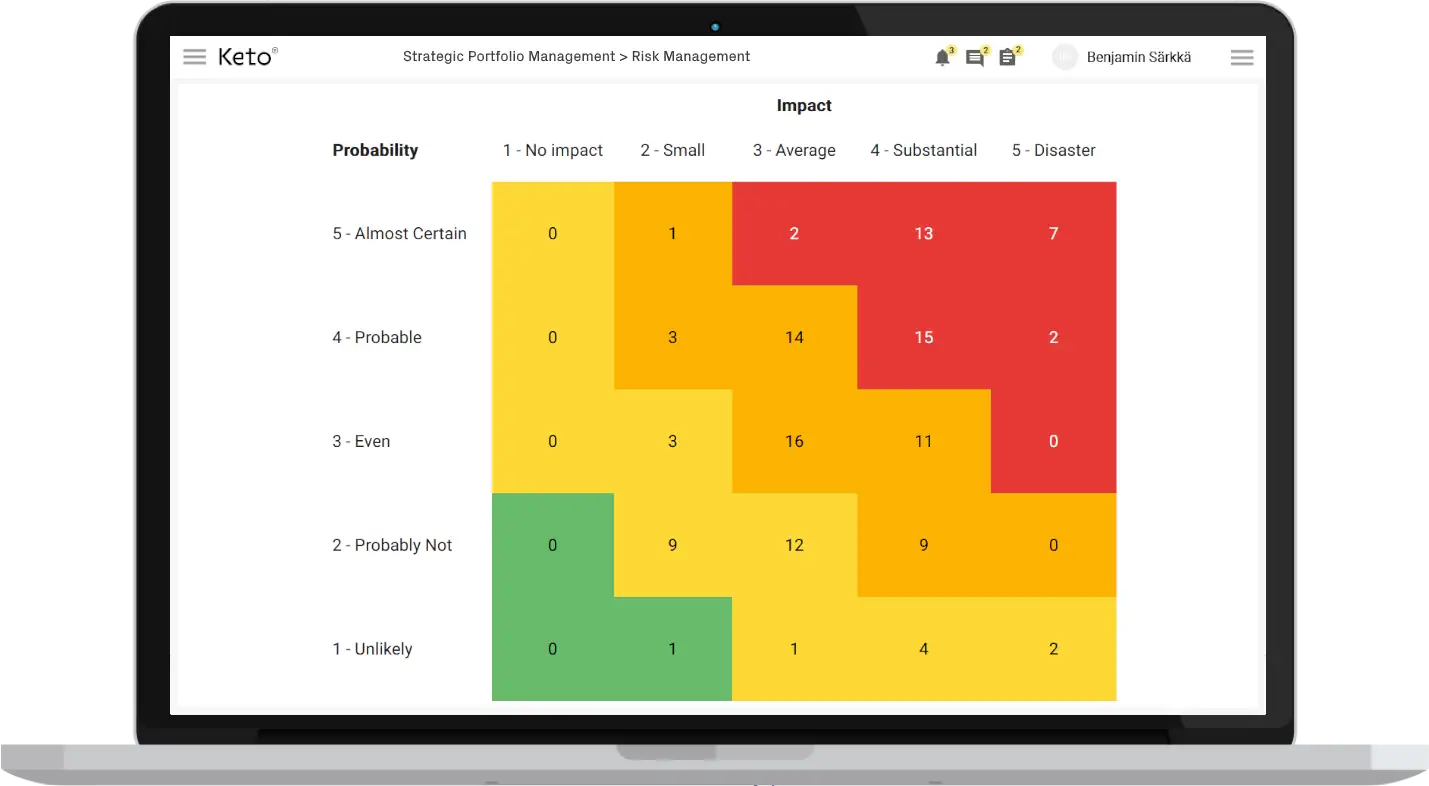

-

Real-Time Risk Dashboards: Keto AI+ provides intuitive dashboards that give a consolidated view of risk exposure at the portfolio, program, and project levels. At a glance, executives and PMO leaders can see the status of all critical risks, color-coded by severity, along with trending risk indicators. These dashboards pull data continuously from ongoing initiatives – budgets, schedules, resource utilization, OKR progress – ensuring that risk metrics are always up to date. This real-time visibility supports effective risk governance and quick decision-making. Instead of waiting for weekly or monthly reports, leaders have a live pulse on where potential trouble is brewing.

-

AI-Generated Risk Alerts: The Keto AI+ platform uses machine learning to analyze historical project data, current performance, and even external factors to predict risk events before they happen. For example, by examining patterns from past projects, the AI might detect that a software development initiative is likely to run X% over schedule given its current burn rate and complexity – triggering an alert to the PMO. If a key risk indicator (like staff availability or cost variance) crosses a threshold, Keto AI+ sends out immediate notifications to relevant stakeholders. These AI-driven alerts function as an early warning system, so teams can investigate and respond to anomalies sooner. As one Gartner webinar noted, being proactive can help narrow the ever-problematic “strategy-to-value gap” in organizations gartner.com. Keto AI+ helps achieve this by shifting risk management from reactive firefighting to predictive prevention gartner.com.

-

Scenario Modeling and Simulation: A standout feature of Keto AI+ for risk officers and portfolio managers is its ability to run what-if scenarios on the portfolio. Users can model changes and risk events in a sandbox – for instance, simulating the impact if Project X is delayed, or if budget Y is cut, or if demand surges for Product Z. The platform then projects how these scenarios would affect timelines, resource allocation, OKR achievement, and overall portfolio health. This capability allows leadership teams to visually compare different courses of action and quantify risk impacts. By testing scenarios, organizations using Keto AI+ can make more informed decisions on risk response and be confident that their strategic portfolio can withstand shocks. It essentially brings sophisticated risk modeling – once the realm of actuarial science – into an accessible dashboard for day-to-day strategy execution planning.

-

Integrated Risk Register and Tracking: Keto AI+ includes robust risk management workflows. Risks can be logged at the strategic initiative level with fields for likelihood, impact, owner, mitigation strategy, and status. The platform links each risk to the relevant strategic objectives or key results it might affect, which keeps focus on why the risk matters. As teams implement mitigation actions, they can update the risk’s status, and those updates roll up to portfolio-level reports. This ensures accountability for risk mitigation – every high-priority risk has an owner and a plan, visible to leadership. It also means the risk register is never static; it’s a living part of the SPM system, updated in real time. Over time, data from resolved risks can be analyzed by the AI to continuously improve risk prediction accuracy (learning from past projects).

By providing these capabilities in one platform, Keto AI+ acts as a force multiplier for risk management. It frees up portfolio managers from clerical work (like aggregating risk reports) so they can focus on analysis and decision-making. And it ensures that when a risk requires attention, it surfaces at the right time with actionable insights. This kind of toolset is increasingly not a luxury but a necessity – as Forrester’s evaluation of SPM solutions suggests, organizations need to “increase understanding of risks… and execution requirements” through better visibility and analytics. Keto AI+ is aligned with that need, offering PMO leaders a way to stay ahead of risks and keep strategy on track.

Fostering a Risk-Aware Culture

Technology and processes alone are not enough – achieving success in strategic portfolio risk management also requires a risk-aware culture. Leadership must set the tone that identifying and discussing risks is not about assigning blame for potential failures, but about enabling success. When teams feel safe to raise red flags early, the organization can address issues in time. Conversely, a culture of hiding or ignoring risks inevitably leads to bigger problems later.

PMO leaders and CIOs should encourage transparency and learning. Every project should begin with a frank risk workshop, and every steering committee meeting should include a risk review. Celebrate “near-misses” that were avoided thanks to proactive risk management – this reinforces positive behavior. Over time, as risk management becomes ingrained, the organization moves from being reactive (always playing catch-up) to proactive and resilient. McKinsey calls this moving from mere risk management to strategic resilience, where companies thrive amid uncertainty by adapting quickly mckinsey.com.

It’s also wise to tie risk metrics into performance evaluations at some level. For example, executives might track metrics such as the percentage of key initiatives with updated risk assessments, or the percentage of risks resolved before escalating in severity. “What gets measured gets done,” and including such metrics signals that risk management is a priority for executing strategy – not an afterthought.

Finally, leadership should define clearly the organization’s risk appetite in the context of strategy. This means articulating how much risk is acceptable in pursuing strategic goals. With a clear risk appetite statement, portfolio decisions become easier: if a proposed initiative carries risks beyond the tolerance, it should be adjusted or not approved. If an active project’s risk profile veers outside the acceptable range, that triggers an immediate review. In this way, risk appetite serves as a guardrail for strategy execution, ensuring the company isn’t unknowingly betting the farm on a high-risk venture or, conversely, playing so safe that it forgoes strategic opportunities. As the saying goes, “The biggest risk is not taking any risk” – effective risk management means finding the sweet spot between caution and boldness.

Turning Risk Management into Strategic Advantage

When properly implemented, risk management is far more than a box-ticking exercise – it becomes a key driver of strategic success. By proactively identifying, monitoring, and mitigating risks, organizations protect their strategic investments and gain the confidence to pursue ambitious goals. Effective risk management at the portfolio level ensures that project selection and execution are continually aligned with the company’s strategic objectives and risk tolerance. It enables informed trade-off decisions (when to take a risk versus when to avoid one) and optimizes the use of resources for maximum strategic impact.

Importantly, robust risk practices also help avoid the costly pitfall of poor project performance. Industry research shows that on average 11.4% of investment is wasted due to poor project outcomes – and organizations that undervalue project management (which includes risk management) see 67% more of their projects failing outright pmi.org. Those are sobering numbers, but they also highlight a clear opportunity: organizations that mature their risk management stand to save significant money and attain more of their strategic targets. In short, managing risks means managing success.

As you strengthen risk management within SPM, leverage the best of both people and technology. Encourage your teams to be vigilant and candid about risks, and support them with tools like Keto AI+ that provide the data-driven insights to act on those risks in real time. The payoff is a more resilient, agile organization that can navigate uncertainty and deliver on its promises. Instead of strategy execution being jeopardized by surprises, it will be bolstered by an early-warning system and readiness plans.

In the end, world-class strategic portfolio management is about balancing risk and reward – taking enough risk to innovate and grow, but not so much that the enterprise is blindsided. With proactive risk management embedded in SPM, organizations can strike that balance. They turn potential threats into managed uncertainties and create a portfolio that can weather storms on the journey to achieving strategic vision. As Gartner and Forrester note, SPM done right builds confidence in strategic investments and unlocks capacity for priority initiatives – benefits that simply cannot be realized without strong risk management. By viewing risk management as a pathway to strategic advantage rather than a bureaucratic hurdle, companies position themselves to execute strategy with greater certainty, agility, and success.

In summary: Strategic and portfolio-level risk management is about expecting the unexpected and being prepared. It empowers organizations to deliver on strategy despite the risks, turning potential roadblocks into mere speed bumps on the path to long-term value creation. With the right mindset, processes, and supporting tools, risk management becomes a source of confidence and competitive advantage – ensuring that no matter how the future unfolds, your strategic portfolio is ready to adapt and thrive.

Read next