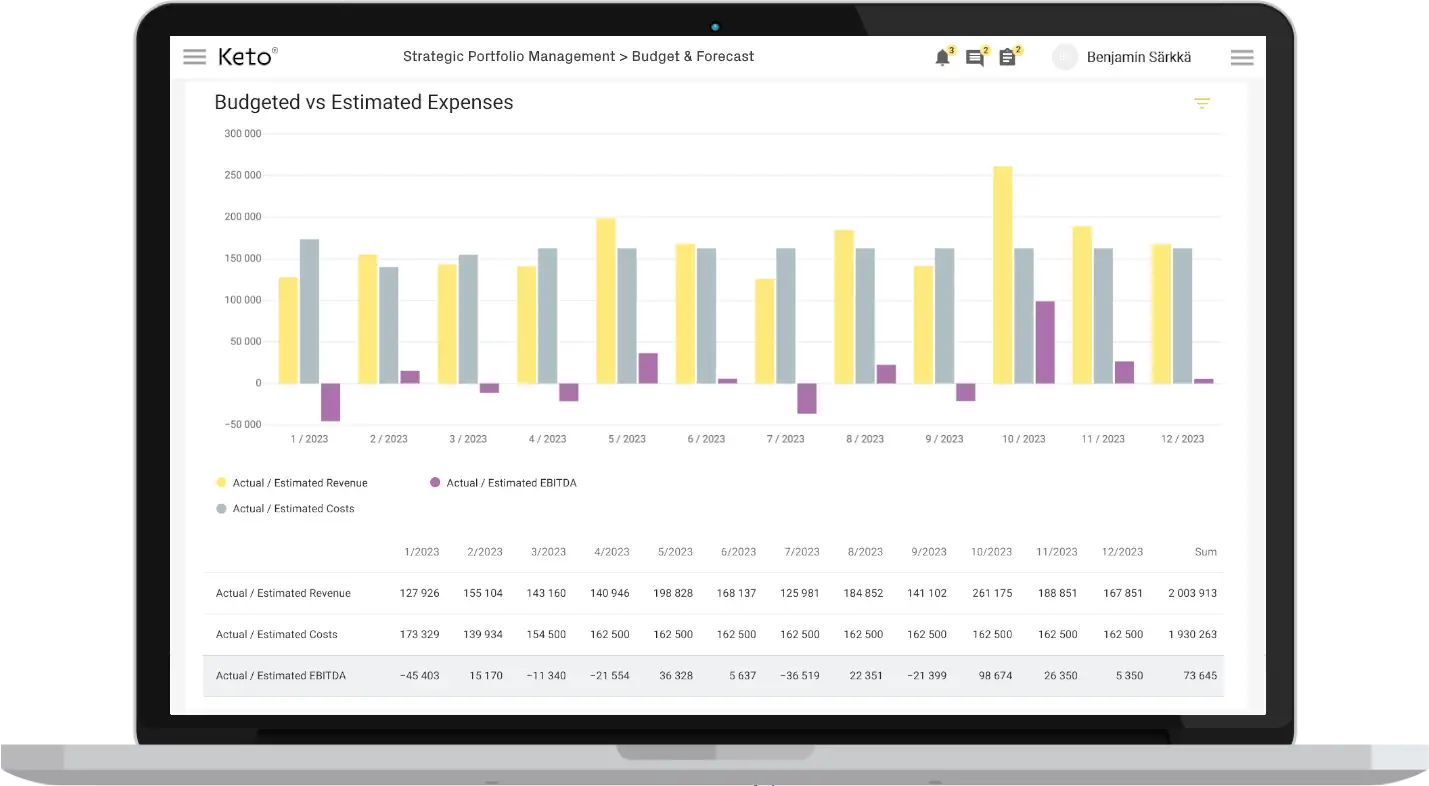

Financial Management as the Cornerstone of Strategic Portfolio Management

At the heart of strategic portfolio management lies financial management. It is the strategic orchestration of financial planning, budgeting, and decision-making processes, fundamental to an organisation's growth.

Financial planning and effective budgeting form the bedrock, driving cash flow management. This, coupled with a well-crafted investment strategy, underpins the organisational goals. Capital management and asset allocation, backed by financial analysis, contribute to resource optimisation.

Financial forecasting opens the door to future economic insights, while transparent financial reporting, which encompasses income statements and cost control, safeguards fiscal health. Working capital management, financial accounting, and corporate finance, including capital budgeting, join forces to fuel economic value and sustainability.

Integrating Financial Management into Strategic Portfolio Management (SPM)

Strategic Portfolio Management (SPM) aligns initiatives with organisational objectives, and financial management is pivotal in this process. It orchestrates budgeting, cash flow management, and investment strategies to drive outcomes. Effective financial planning and capital management inform asset allocation, while financial analysis and forecasting provide valuable insights. The resulting financial reporting offers transparency, supporting informed decision-making. Working capital management, financial accounting, and corporate finance play crucial roles. Capital budgeting aligns investments with goals, making financial management a vital component of SPM.

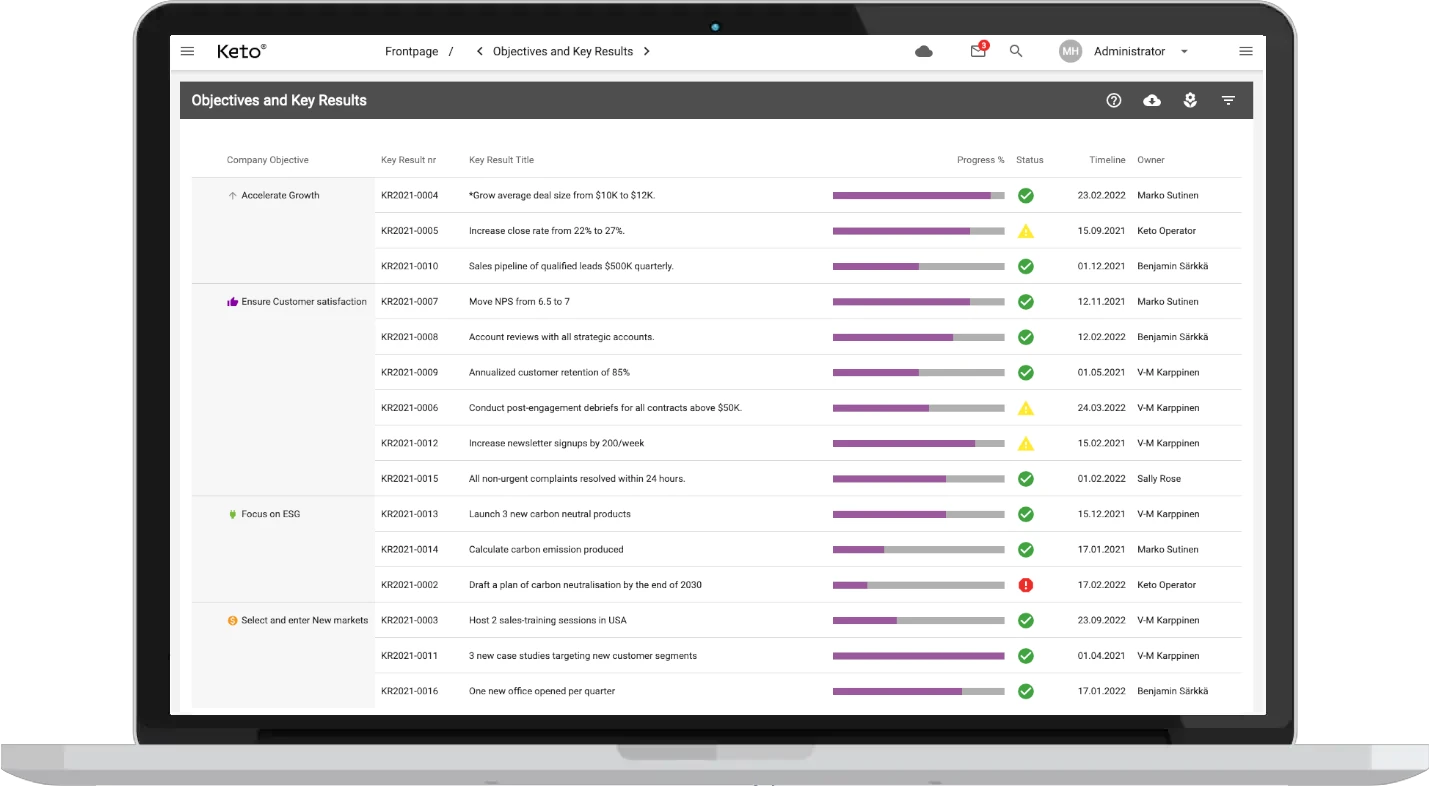

OKRs and Financial Management: Aligning Finance with Organisational Goals

OKRs, key for strategic direction, tightly intertwine with financial management. Budgeting aligns to OKRs, providing necessary funding. Cash flow and capital management orchestrate asset allocation, while investment strategies secure resources. Financial analysis and forecasting anticipate future needs. Transparency is maintained by financial reporting and cost control, ensuring the achievement of OKRs. Working capital management, financial accounting, and corporate finance safeguard financial health. Capital budgeting guides investment to align with OKRs, symbolising their synergy.

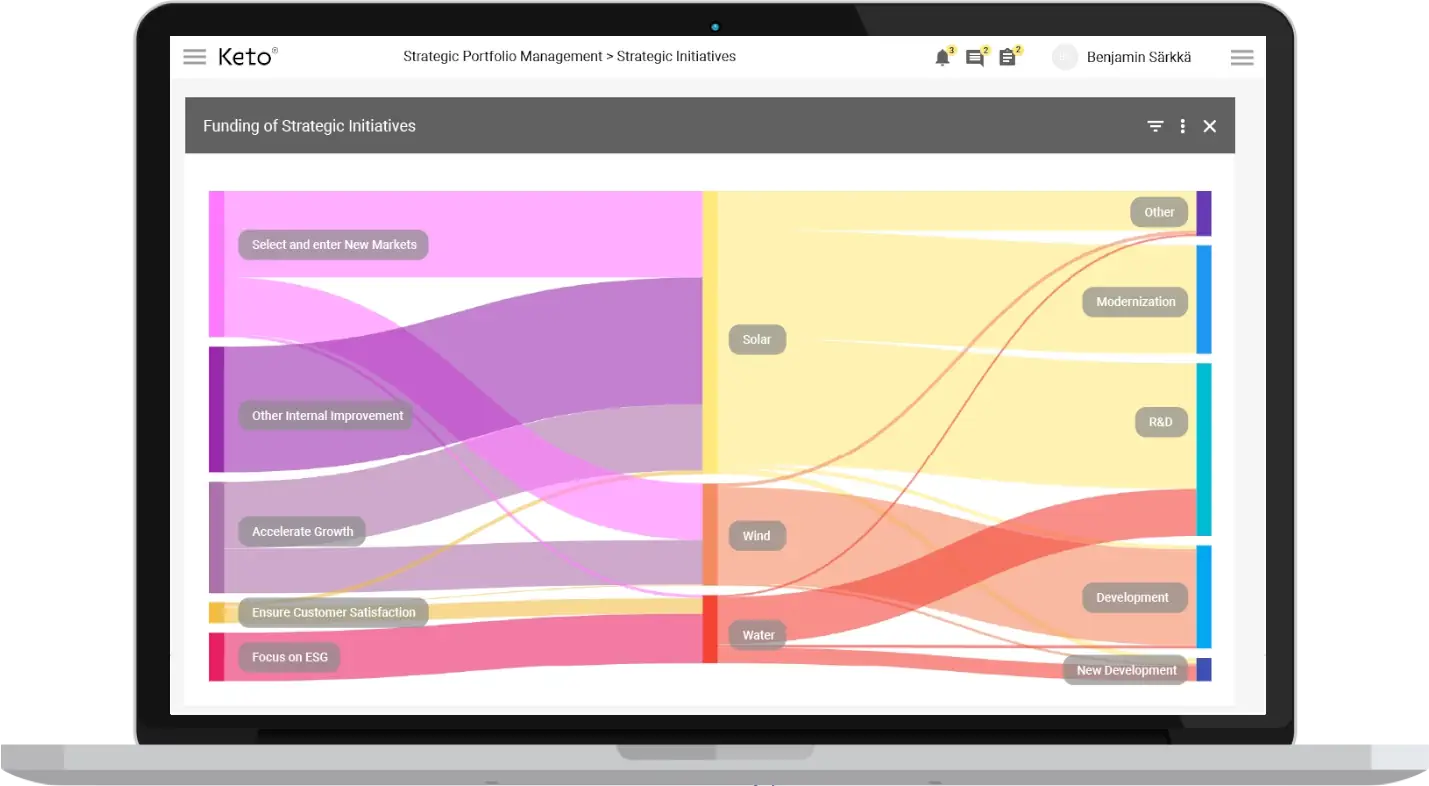

Strategic Initiatives and Financial Management: Funding for Success

Strategic initiatives, high-impact actions for organisational goals, lean heavily on financial management. This starts with budgeting to set financial outlines. Cash flow management and capital management ensure sufficient liquidity and asset allocation for these initiatives. Investment strategy, financial planning, and financial analysis optimise resource use. Financial forecasting aids in anticipating future funding needs, while financial reporting provides transparency. Cost control and working capital management maintain financial health. Lastly, financial accounting and corporate finance ensure regulatory compliance and effective capital budgeting guarantees optimal investment in initiatives.

Programme and Project Management: Ensuring Financial Feasibility

Within the purview of programme and project management, financial management stands as the fiscal backbone ensuring viability. The process initiates with budgeting, allocating the right resources to each task. Cash flow management and capital management aid in maintaining the fluidity of operations. Investment strategy and financial planning streamline the allocation of funds. Through financial analysis, costs and returns are evaluated. Financial forecasting anticipates budget requirements, whereas financial reporting promotes transparency. Stringent cost control and working capital management assure a balance between expenses and available funds. Lastly, financial accounting ensures adherence to standards, and corporate finance and capital budgeting validate strategic investment decisions.

Read more about Advanced Analytics and AI in Strategic Portfolio Management

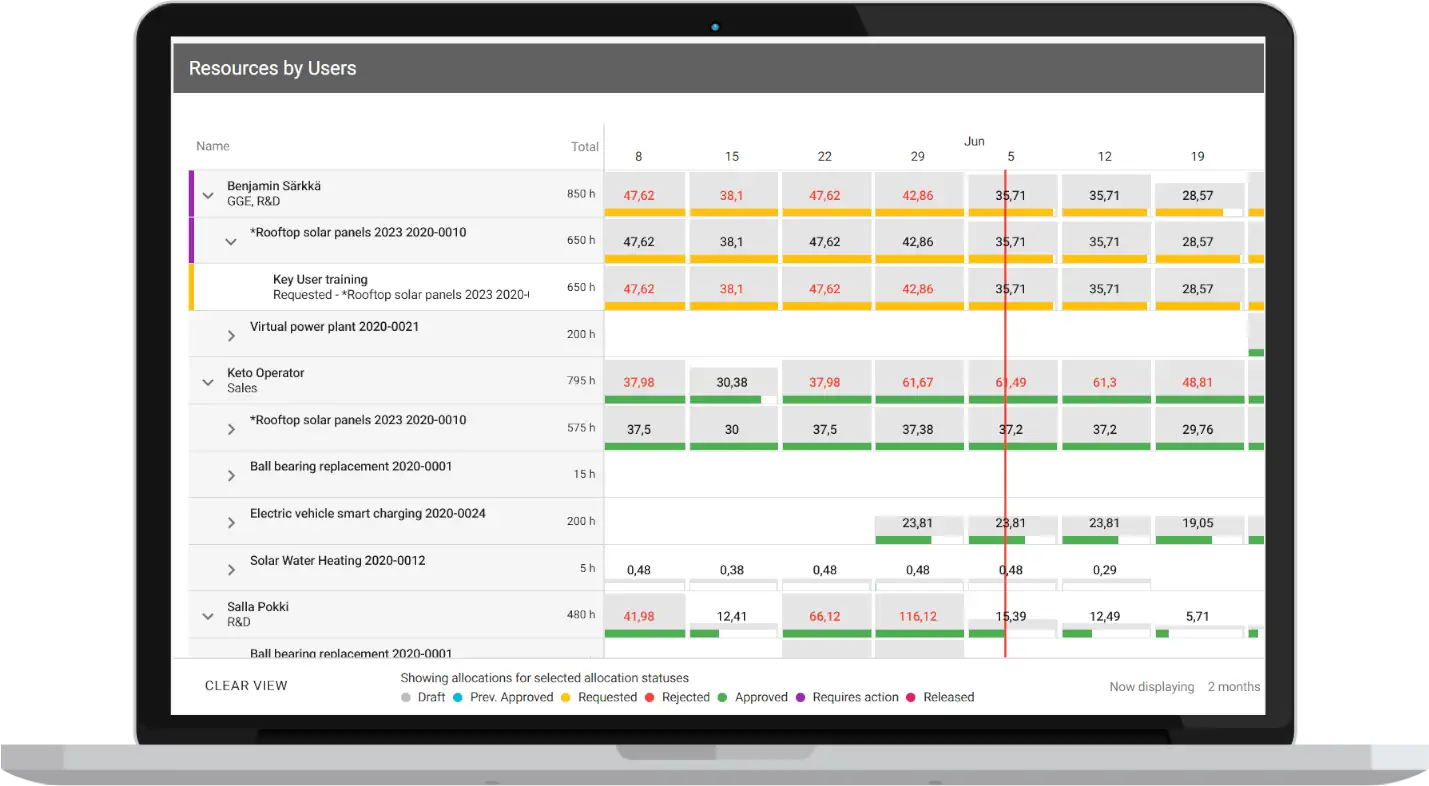

Capacity Management and Financial Management: Optimal Resource Allocation

Synchronized with capacity management, financial management optimises resource allocation. This synergy begins with budgeting and cash flow management, aligning monetary resources with the organisation’s capacities. Investment strategies and financial planning ensure effective allocation of capital, underlining the importance of capital management. Asset allocation correlates the financial resources with different capacities, optimising balance. Financial analysis and forecasting provide critical insights for future resource requirements, facilitating proactive planning. Financial reporting creates transparency in resource use, while cost control and working capital management ensure efficient use of financial resources. Ultimately, corporate finance and capital budgeting decisions underpin the strategic allocation of resources, guided by sound financial accounting.

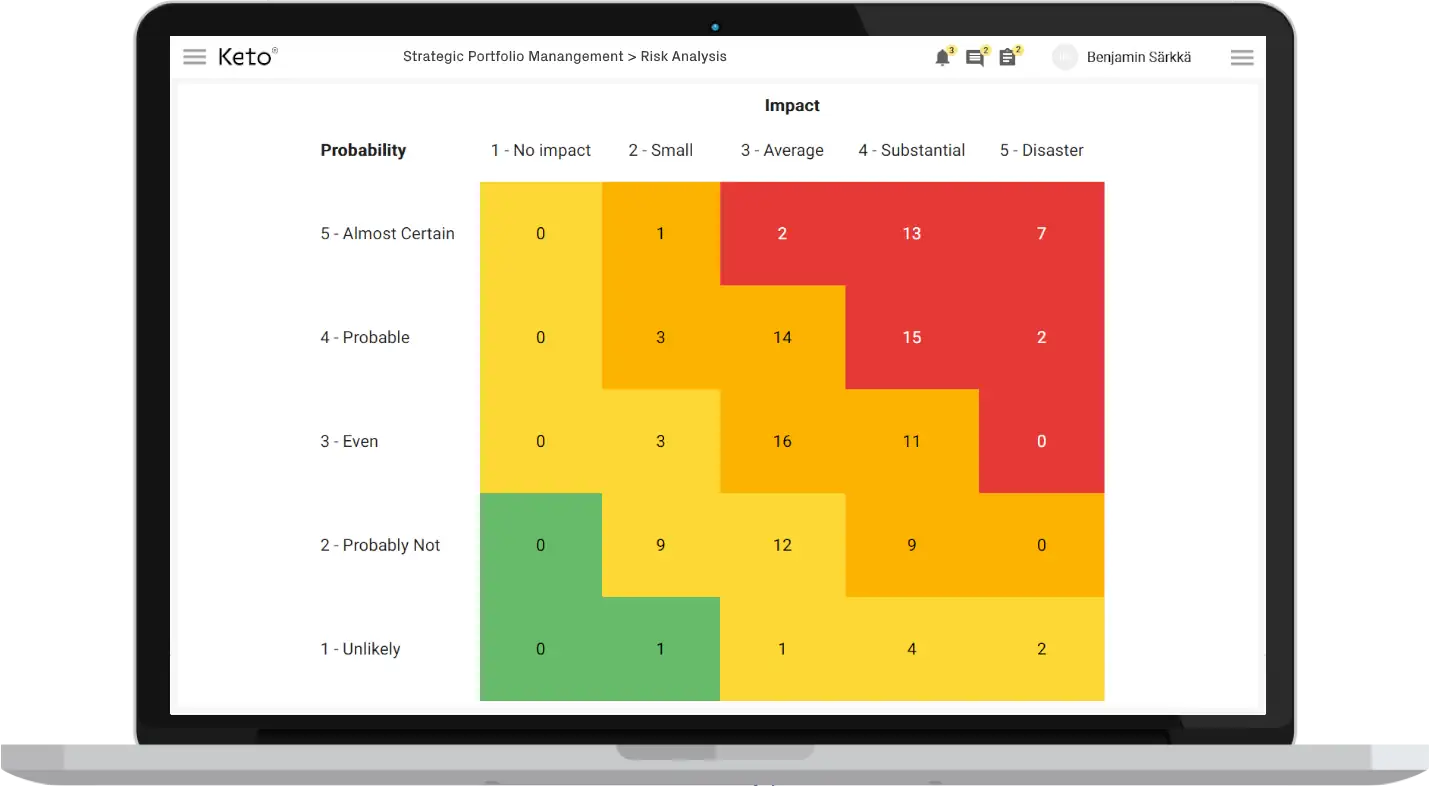

Risk Management and Financial Management: Safeguarding Financial Assets

Risk management and financial management are interwoven facets, together safeguarding an organisation’s financial assets. Through budgeting and cash flow management, they identify financial risks and devise strategies to combat these uncertainties.

Introducing the Keto AI+ Platform: Enhancing Financial Risk Management

In the intricate landscape of financial management, the emergence of the Keto AI+ platform symbolizes a groundbreaking fusion of cutting-edge technology and financial risk strategy. This AI-driven platform brings predictive analytics to the forefront, allowing for early identification of potential financial vulnerabilities and offering preemptive solutions.

Leveraging historical data and aligning it with real-time financial metrics, Keto AI+ can predict fluctuations in cash flow, foresee changes in capital management, and offer insights into potential disruptions in investment strategies. This form of advanced financial analysis, backed by AI, elevates risk management from a reactive practice to a proactive strategy. The platform’s instantaneous alert system ensures that any deviations from financial benchmarks are instantly flagged, thus enabling timely interventions.

Returning to traditional risk management practices, investment strategies take into account risk parameters, while financial planning lays a road map to navigate potential financial turbulences. Capital management and asset allocation directly address financial risks by optimising the use of resources. Financial analysis and forecasting provide insights into future risks, enabling proactive measures. Regular financial reporting highlights risk factors, while cost control and working capital management tactics curtail unnecessary financial exposure. The principles of financial accounting offer a framework to manage risks associated with corporate finance, while capital budgeting decisions inherently consider potential risks and rewards. Together, these strategies fortify financial stability.

Financial Management: A Key Component of the SPM Solution

Financial management is a cornerstone of Strategic Portfolio Management (SPM), integrating elements such as budgeting, cash flow management, and investment strategies. It plays a pivotal role in financial planning, influencing decisions in capital management and asset allocation. It offers valuable insights through financial analysis and forecasting, guiding strategic initiatives and OKRs. Financial reporting provides a clear picture of an organisation’s financial health, enabling cost control and efficient working capital management. Understanding financial accounting is crucial in managing corporate finance, while capital budgeting decisions serve as a roadmap for investment strategies. The amalgamation of these facets forms a holistic SPM solution, aligning financial strategy with organisational goals to foster sustainable success.

Read next