Financial Management as the Cornerstone of Strategic Portfolio Management

Financial management sits at the heart of Strategic Portfolio Management (SPM), serving as the glue that links an organization’s strategy with its financial execution. For CFOs and finance leaders, this means orchestrating financial planning, budgeting, and investment decisions in a way that drives strategic growth. It’s not merely about keeping the books – it’s about governing investments, forecasting the future, ensuring benefits are realized, and steering strategic execution across the enterprise portfolio. As Forrester notes, SPM “plays a crucial role in how firms deliver value to their clients and organization”. In practice, effective financial management within SPM gives CFOs visibility and control to allocate resources to the right initiatives, at the right time, for the right outcomes.

Modern research underscores why financial management is a cornerstone of SPM. Gartner emphasizes that SPM establishes “proper governance by defining processes, roles, and responsibilities for making investment decisions” – a critical insight for CFOs overseeing enterprise investments. Meanwhile, a 2023 McKinsey survey found that only about half of companies effectively align their budgets with corporate strategy. Just over 50% transform strategic goals into multi-year (3–7 year) financial plans, and only 53% fully fund their strategic priorities. Those that do align financial plans to strategy are far more likely to outperform peers in revenue growth and return on capital. The message is clear: linking finance to strategy through robust portfolio management is no longer optional – it’s imperative for value delivery.

In this guide, we explore how CFOs and mid-tier finance professionals can strengthen their strategic portfolio management through four key financial management practices: investment governance, multi-year forecasting, benefits realization, and execution monitoring. Along the way, we’ll highlight use cases (including how tools like Keto AI+ integrate budgets, forecasts, ERP actuals and performance data) and insights from Gartner, McKinsey, PMI, and Forrester. Each section is structured for quick scanning, with short explanations and examples to illustrate the concepts. Let’s dive in.

Investment Governance: Aligning Capital with Strategy

One of a CFO’s foremost responsibilities in SPM is investment governance – ensuring that every major project or program is evaluated and funded according to strategic merit. Good governance means having the right structure and criteria in place to decide where the company’s money goes. According to Gartner, SPM helps enterprises implement precisely this by defining clear processes, roles, and responsibilities for investment decisions. In practice, this might involve establishing an investment committee or portfolio board (often including the CFO, CEO, and other executives) that regularly reviews the portfolio of initiatives.

Why is this important? Proper investment governance ensures that resources flow to initiatives that best support the organization’s objectives – and that pet projects or low-value efforts are filtered out. It creates discipline around budgeting and approvals. For example, a governance board might require every project above a certain cost to present a business case linking back to strategic goals and ROI, as well as undergo stage-gate reviews. This aligns spending with strategy and avoids ad-hoc decisions. Research by McKinsey has shown that companies which rigorously reallocate resources to strategic priorities (rather than sticking to last year’s budget allocations) achieve significantly higher returns mckinsey.com.

How financial management supports governance: Finance teams provide the data and analysis that fuel investment decisions. Through capital budgeting and financial analysis, CFOs can compare potential investments on an “apples to apples” basis – looking at projected cash flows, ROI, NPV, and risk for each proposal. They also enforce financial controls, ensuring that once approved, projects stay within budget or follow proper change control if more funds are needed. By maintaining transparency (e.g. via dashboards of budget vs. actual spend per initiative), finance ensures the governance body has up-to-date information. In short, effective financial management gives the governance process teeth: decisions are based on facts and strategic fit, not gut feel.

CFO Tip: Make investment governance a continuous process, not a one-time annual budget exercise. Many leading organizations hold quarterly portfolio reviews to rebalance funding as conditions change. This kind of agile governance lets you double down on winners or pull back from underperforming investments sooner, keeping the portfolio optimized.

Multi-Year Forecasting and Financial Planning (Looking Beyond the Annual Budget)

Annual budgets alone are not sufficient for strategic execution. CFOs are increasingly expected to provide multi-year forecasts and financial plans that map out the trajectory of strategic initiatives over 3, 5, or even 10 years. This long-term view is a core component of SPM because big strategic bets (e.g. a digital transformation program, a new product line, an expansion into a new market) often play out over multiple budget cycles. Multi-year financial forecasting aligns these strategic roadmaps with the reality of financial capacity and expected returns over time.

Why is multi-year planning so critical? As one governance expert put it, it allows leaders to “model out the effect of decisions we are making today” on the future. In other words, a decision to invest $50M in a new program isn’t just this year’s $10M budget line – it implies commitments and benefits that span several years. By forecasting revenues, expenses, and capital needs over a multi-year horizon, CFOs help the organization anticipate whether it can sustain its strategy (and what the payback will look like). This long-range sight also enables early warning: if a few years out the costs start to outweigh the benefits, plans can be adjusted proactively.

However, many companies struggle here. McKinsey’s recent survey highlights that barely half of companies consistently translate their strategy into a 3-7 year strategic financial plan

mckinsey.com. And in many firms, the annual budget isn’t well aligned to that long-term plan – often, last year’s spending simply rolls over with incremental changes. CFOs can break this cycle by introducing rolling forecasts and scenario planning as part of SPM. For instance, a CFO might maintain a rolling 5-year projection that is updated quarterly with actuals and latest assumptions, alongside best-case and worst-case scenarios for each major strategic initiative. This dynamic forecasting approach ensures agility: when market conditions shift or new opportunities arise, the multi-year outlook can be quickly recomputed to show the impact on strategy and liquidity.

How financial management supports multi-year SPM: Key practices include strategic financial modeling (linking project/program plans to financial outcomes over multiple years), capacity planning (ensuring you can fund not only this year’s projects but next year’s expansions or follow-on phases), and financial risk analysis (identifying where future budget shortfalls or cost overruns might occur). Many CFOs leverage financial management software or SPM tools to consolidate these projections. Such tools can integrate portfolio roadmaps with financial data – so that if a project timeline changes, the forecasted spend and benefits in each year adjust accordingly. The result is a financial roadmap for strategy: a time-phased view of costs, revenues, and value that the entire leadership team can reference when making decisions. It also supports communications with the board and investors, who want to see how strategic goals translate into financial outcomes over time.

Benefit Realization and Value Tracking

Strategic portfolios exist to create value – but how do you know if you’re actually realizing the benefits you set out to achieve? Benefits realization is the practice of planning, measuring, and ensuring that the outcomes of initiatives deliver the expected business value. For CFOs, this is where financial management and strategy truly come together: it’s not enough to complete projects on time and on budget if they don’t yield the returns or improvements promised. As the Project Management Institute (PMI) defines it, “Benefits realization management (BRM) provides organizations with a way to measure how projects and programs add true value to the enterprise.” pmi.org.

Despite its importance, benefits tracking is an area of relative weakness for many organizations. PMI studies have found low maturity in benefits realization across a majority of companies pmi.org, which often correlates with a higher rate of failed or underperforming projects. This presents an opportunity for CFOs and finance teams to lead. Finance is well-positioned to quantify benefits (in financial terms like revenue growth, cost savings, or improved margins) and to implement the controls to track these benefits through time. By treating benefits like you treat costs – with targets, owners, and regular status checks – you instill accountability for results.

Implementing benefits tracking: Start by requiring each strategic initiative to have a business case that outlines expected benefits (financial and even non-financial, if you can quantify things like customer satisfaction or market share). Ensure these benefits have clear metrics and timeframes (e.g. “$5M incremental revenue in FY2025, $8M in FY2026”). During execution, use financial reporting and operational KPIs to monitor progress toward these benefits. For example, if a project’s benefit is cost reduction, the finance team should track actual costs before and after project implementation to verify the savings. Similarly, for revenue-uplift initiatives, link the project to changes in sales or new customer acquisition.

A crucial part of benefits realization is post-implementation review. CFOs can institute a process to evaluate each major initiative 6-12 months after completion to see if it delivered the value promised. If not, analyze why – was the benefit overestimated, or was the execution short of expectations? These insights can refine future estimates and also trigger corrective actions (for instance, if an implemented system isn’t delivering productivity gains, maybe additional training or process changes are needed). This focus on outcomes ensures that the strategic portfolio truly drives business performance, not just activity.

From a strategic portfolio perspective, tracking benefits helps close the loop between strategy formulation and execution results. It provides feedback to the strategic planning process: confirming which types of initiatives yield high ROI and which do not. As Forrester observed, SPM is fundamentally about guiding investments to maximize value forrester.com – and value can only be maximized if it is measured. By embedding benefits realization into financial management practices, CFOs champion a value-centric culture. Every project manager and business sponsor knows that success isn’t just delivering on time – it’s delivering the expected value to the organization’s bottom line or mission.

Execution Control: Linking Plans, Budgets, and Actual Performance

Even with strong up-front governance and planning, strategic execution can go off course without continuous financial oversight. Execution control in the context of SPM means having real-time visibility into how initiatives are performing against their budgets, forecasts, and intended outcomes – and being able to course-correct in a timely manner. For CFOs, this translates to integrating financial management deeply into project/program management. It’s about linking the plan to reality: as projects run, are we spending as expected? Are we hitting our milestones and benefit targets? If variances occur, what decisions must be made now?

A classic challenge is the disconnect between the finance department’s reports (which might come monthly, after the fact) and project status updates (which might be qualitative or lagging). Modern SPM platforms aim to eliminate this disconnect by unifying financial and project data. For instance, consider a scenario where your ERP system records actual expenditures on a project, while your project management tool tracks percent completion. By linking these systems, a CFO can see a live “budget vs. actual vs. forecast” view at any time – not just during month-end close.

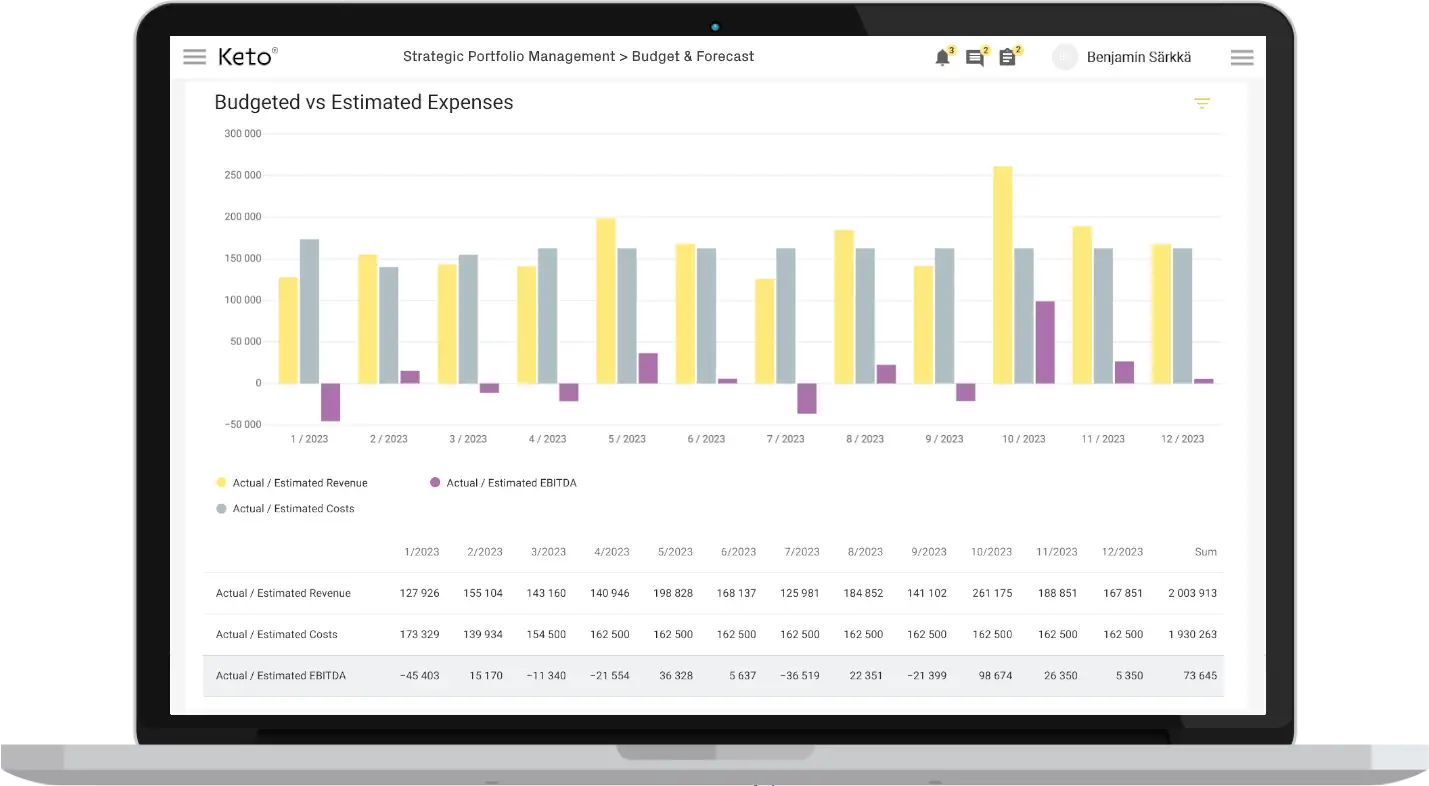

Figure: Example of a Strategic Portfolio Management dashboard (Keto AI+ Platform) showing budgeted vs. actual expenses over a multi-month timeline. Such tools integrate financial data (budget, actual costs, forecasts) with project performance metrics in real time, giving CFOs instant visibility into execution.

Having this integrated view enables exception-based management. If a particular initiative is 50% through its schedule but has used 70% of its budget, the system can flag it to finance and portfolio managers for attention. Similarly, if the expected benefit (say, revenue from a new product launch) is trending below forecast, the variance is visible and can be discussed. According to Forrester, applying such real-time analytics and adaptive delivery is part of what makes high-performance organizations successful – it “supports the continuous improvement of business results through technology planning and delivery.” forrester.com.

Role of tools like Keto AI+: Technology is a key enabler in execution control. The Keto AI+ Platform, for example, is designed to connect financial plans with execution data in one place. CFOs using such a tool can:

- Integrate ERP Actuals with Portfolio Plans: Keto AI+ can pull actual spending data from ERP systems (e.g., SAP) and match it against the budget and forecast for each project or program. This provides a single source of truth for financial status. No more manually reconciling spreadsheets – the data updates automatically.

- Track Forecasts and Multi-Year Financials: The platform supports multi-year forecasting at both project and portfolio level. As timelines or assumptions change, leaders can immediately see impacts on, say, the 3-year capital plan or the expected ROI of the portfolio.

- Dashboard and Alerts: CFOs and PMOs get dashboards with key metrics (budget used, forecasted to complete, variance, benefit metrics, etc.). AI-driven analytics can highlight anomalies – for instance, flagging if a project’s burn rate indicates it will exceed budget in 6 months, or if a benefit metric (like user adoption) is lagging, risking value realization.

- Scenario Analysis: Some advanced SPM tools let you run scenarios (e.g., “What if we delay Project X by 6 months – how does it affect cash flow and benefits?”). This helps in making execution decisions such as re-prioritizing or re-sequencing initiatives based on real data.

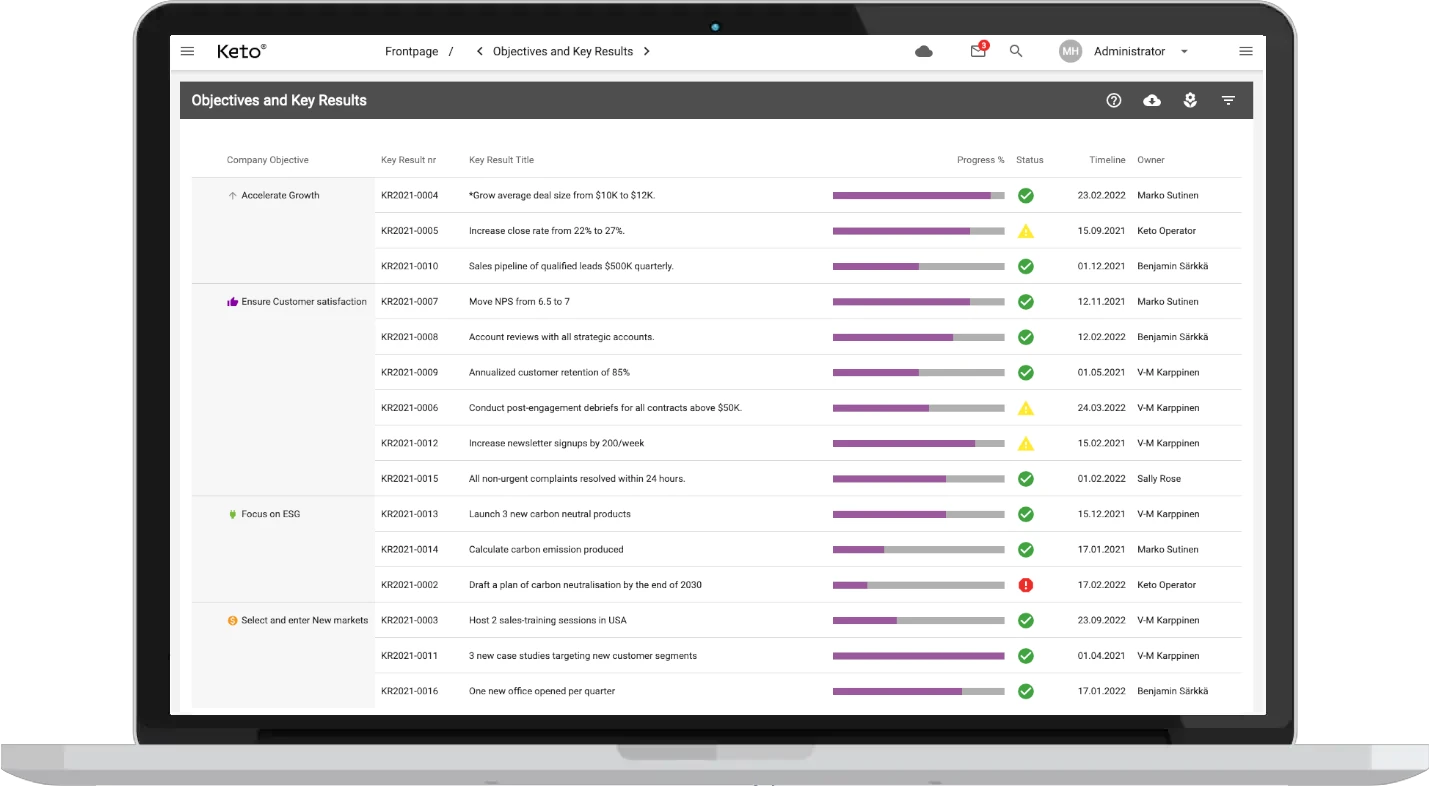

- Performance to OKRs/Strategy: Execution control isn’t only about dollars – it’s also about outcomes. Keto AI+ and similar platforms allow linking each investment to strategic objectives or OKRs and tracking progress. This ensures that as you spend, you can also see the strategic yield of that spend in terms of goal achievement.

The net effect for a CFO is better control and fewer surprises. When financial management is embedded in execution, mid-course corrections can happen in time to protect the portfolio’s value. For example, if a project is forecast to deliver less benefit than expected, perhaps additional features can be added to increase value, or the project can be stopped and its funds reallocated to higher-impact work (thus preventing waste). If one program is coming in under budget, maybe those funds can be shifted to another initiative that needs extra investment – optimizing the overall portfolio return. This agility in execution is a hallmark of organizations with mature SPM practices. In fact, Gartner observed that organizations effective at dynamic reallocation and adjustment – essentially strong execution control – are far more likely to achieve their strategic objectives.

Conclusion

In conclusion, financial management is the cornerstone of successful Strategic Portfolio Management. For CFOs and finance professionals, excelling in this area means your organization’s grand strategies aren’t just PowerPoint slides – they are fully-funded, well-governed plans with clear value targets and rigorous execution monitoring. By focusing on investment governance, multi-year forecasting, benefit realization, and real-time execution control, you ensure that every euro, dollar or yen invested is working toward strategic goals and delivering measurable value.

The journey to this level of oversight and agility is greatly aided by modern tools. As we’ve seen, platforms like Keto AI+ offer an integrated solution to link budgets, forecasts, ERP actuals, and performance tracking into a cohesive whole. Gartner’s vision of SPM emphasizes portfolio alignment and value-based decisions – exactly what such technology empowers, by providing a live “boardroom ready” view of your strategy’s execution.

For CFOs ready to elevate their financial management practice into a strategic advantage, the next step is to explore these capabilities firsthand. We invite you to request a demo of the Keto AI+ Platform – see how it can unify your portfolio data, provide AI-driven insights, and give you command over your strategic investments from planning through to results. With the right approach and tools, financial management moves from a back-office function to a strategic driver of enterprise success.

Read next